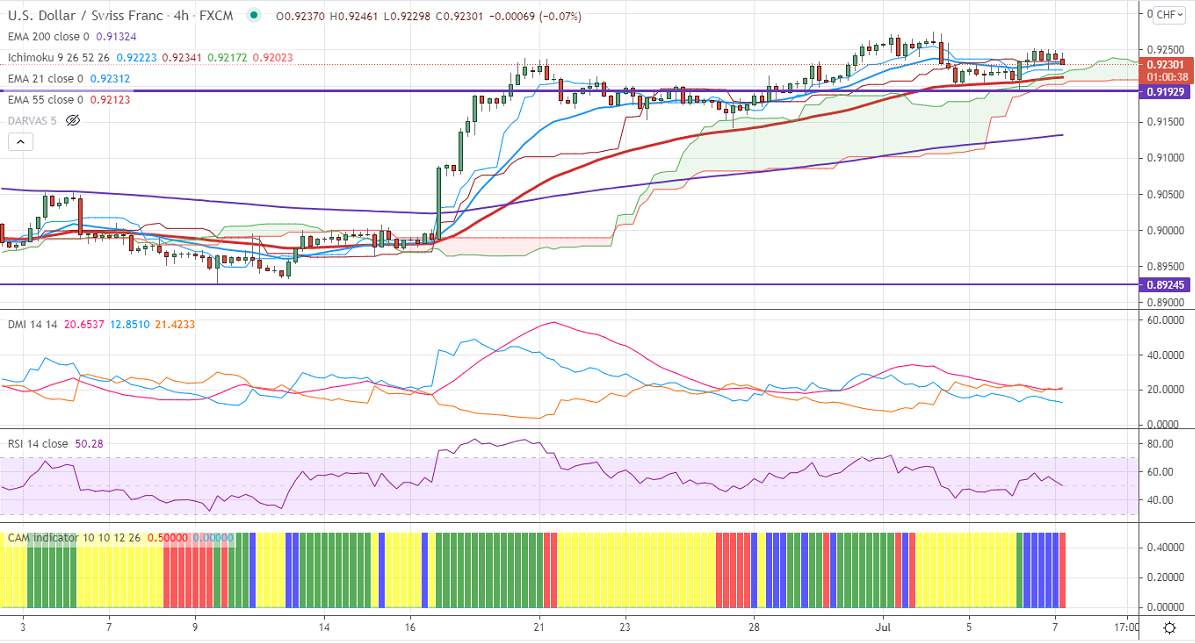

Ichimoku analysis (4-Hour chart)

Tenken-Sen- 0.92223

Kijun-Sen- 0.92341

Previous week High– 0.92748

Today's Low- 0.9190

The pair is trading flat for the past five days between 0.92715 and 0.91933. The intraday bias is neutral as long as support 0.9140 holds. The board-based recovery in the US dollar is supporting the pair at lower levels. Markets eye US FOMC meeting minutes for further direction.

Trend- Neutral

The near-term support is around 0.9190, breach below will take the pair to 0.9125/0.9090. On the higher side, immediate resistance is around 0.92750. Any convincing breach above targets 0.9300/0.9365.

Indicator (4 Hour chart)

CAM indicator –Slightly bullish

Directional movement index –Neutral

It is good to buy on dips around 0.9208-10 with SL around 0.91800 for a TP of 0.9300.