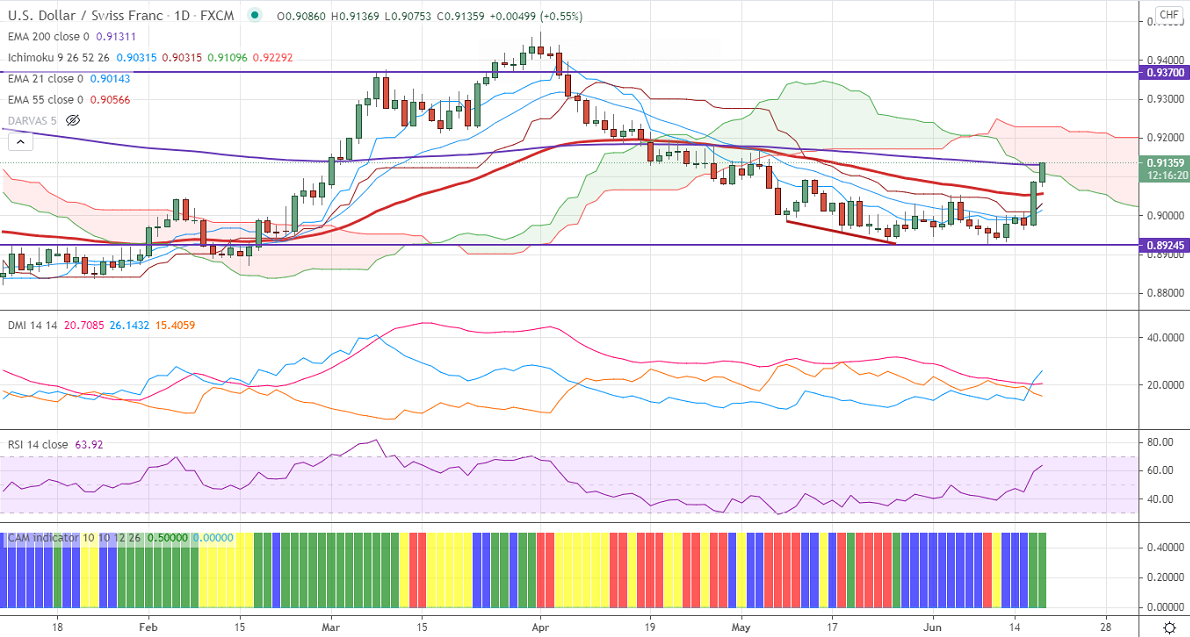

Ichimoku analysis (Daily chart)

Tenken-Sen- 0.90073

Kijun-Sen- 0.9010

USDCHF has formed a double bottom around 0.8920 and surged nearly 200 pips on hawkish Fed monetary policy. The central bank has kept its rates unchanged and upgraded its growth and inflation outlook. The Fed dot plot shows that there will be two rate hikes in 2023. The US 10-year bond yield surged more than 10% after the monetary policy. The pair is holding well above 0.9100 level and hits an intraday high of 0.91327.

Intraday day outlook:

Trend- Bullish

The pair is holding above daily Kijun-Sen, Tenken-Sen, and below the cloud. The near-term resistance is around 0.91300. Any indicative break above will take the pair to next level to 0.9160/0.9200/0.9265. On the lower side, near-term support is around 0.9080. Any convincing breach above targets 0.9050/0.9000. Significant selling will happen only if it breaks 0.8920.

Indicator (Daily chart)

CAM indicator – Bullish

Directional movement index –Bullish

It is good to buy on dips around 0.9120 with SL around 0.9070 for TP of 0.9260.