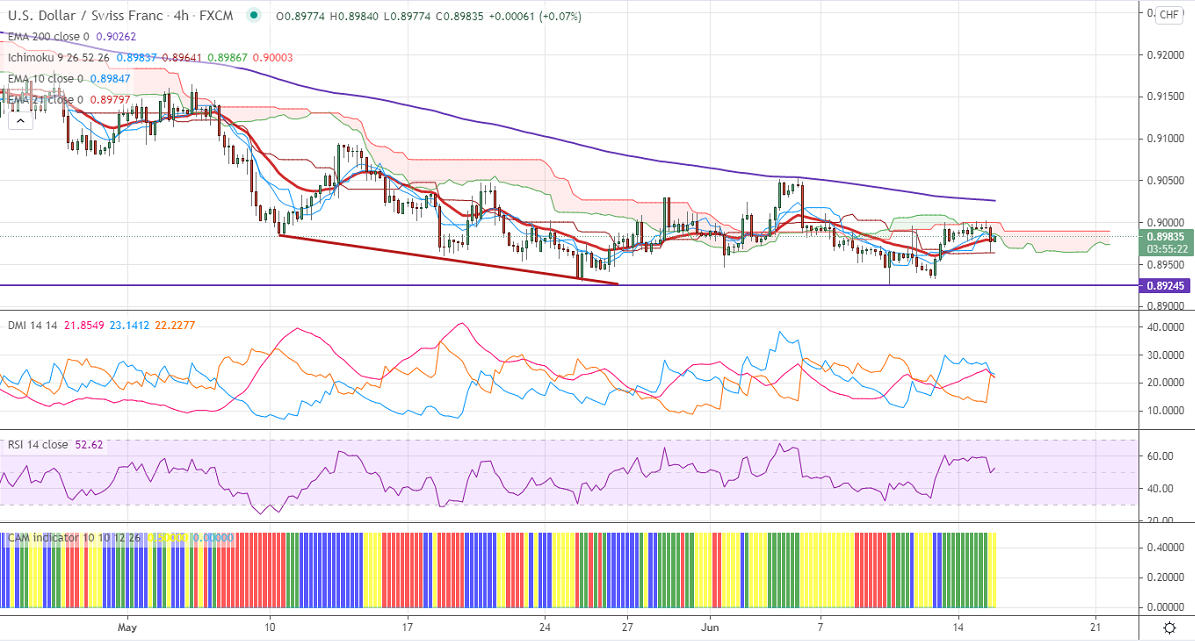

Ichimoku analysis (4-Hour chart)

Tenken-Sen- 0.89897

Kijun-Sen- 0.89641

USDCHF has once again declined after a minor pullback above 0.9000. The short-term trend is still on the downside as long as resistance 0.9055. Markets eye US retail sales data which is to be released today for further direction. The dollar index has formed a double top around 90.62 and shown a minor sell-off. The long-term trend is still on the downside as long as resistance 0.94725 holds.

Intraday day outlook:

Trend- Bearish

The pair is holding below 4- Hour cloud, Tenken-Sen, and below Kijun-Sen. The near-term support is around 0.8920. Any indicative break below will take the pair to next level to 0.8860/0.8800. On the higher side, near-term resistance is around 0.9000. Any convincing breach above targets 0.9030/0.9055. Significant buying will happen only if it breaks 0.9055.

Indicator (4-Hour chart)

CAM indicator – Neutral

Directional movement index – Neutral

It is good to buy above 0.9055 with SL around 0.9020 for a TP of 0.9150.