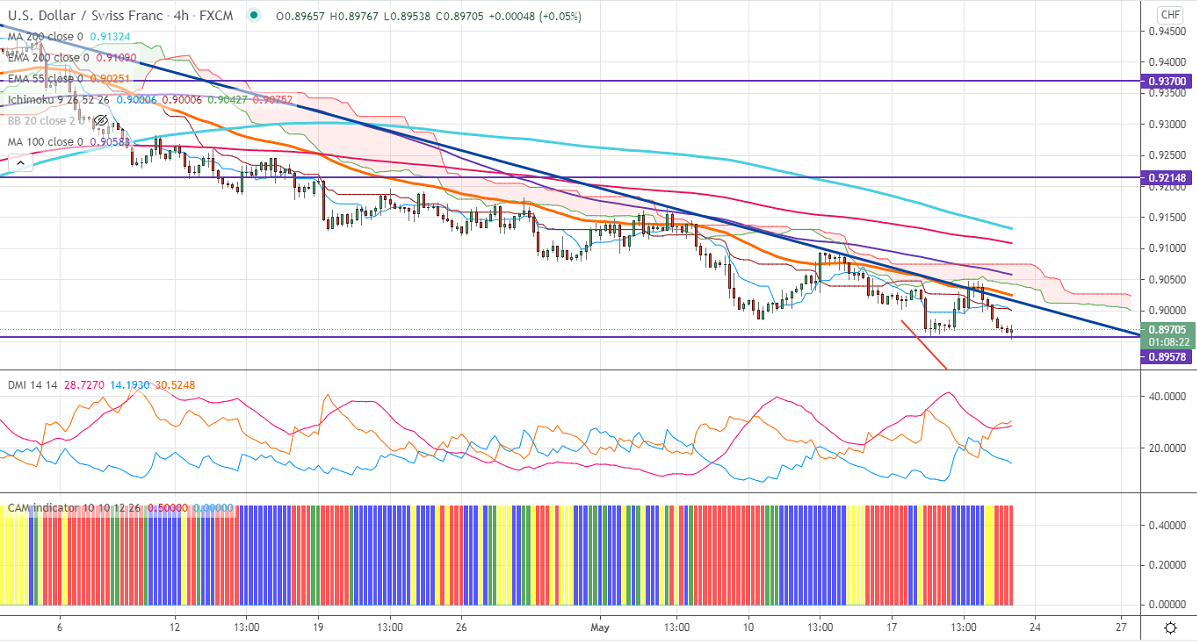

Ichimoku analysis (4-Hour chart)

Tenken-Sen- 0.90057

Kijun-Sen- 0.90038

USDCHF continues to trade weak after a minor pullback. The pair hits a fresh weekly low after breaking 0.8960(May 18th low) on board-based US dollar selling. The decline in US bond yields is also putting pressure on this pair. The US 10-year bond yield lost more than 4%. The number of people who have filed for unemployment benefits declined to 444000 the previous week compared to a forecast of 453K. The Philadelphia Federal reserve business activity fell to 31.5 in May from 50.2 in Apr. The intraday trend is weak as long as resistance 0.9045 holds. The US dollar jumped more than 50 pips from minor bottom 89.69. The long-term trend is still on the downside as long as resistance 0.94725 holds.

Intraday day outlook:

Trend- Neutral

The pair is holding well below 4- H Kijun-Sen, Tenken-Sen, and cloud. The near-term support is around 0.8960. Any close below 0.8960 will take the pair to next level to 0.8900/0.8835. On the higher side, near-term resistance is around 0.9050. Any breach above targets 0.90925/0.9150.

Indicator (4-Hour chart)

CAM indicator – Bearish

Directional movement index – bearish

It is good to sell on rallies around 0.9018-20 with SL around 0.9050 for a TP of 0.8900.