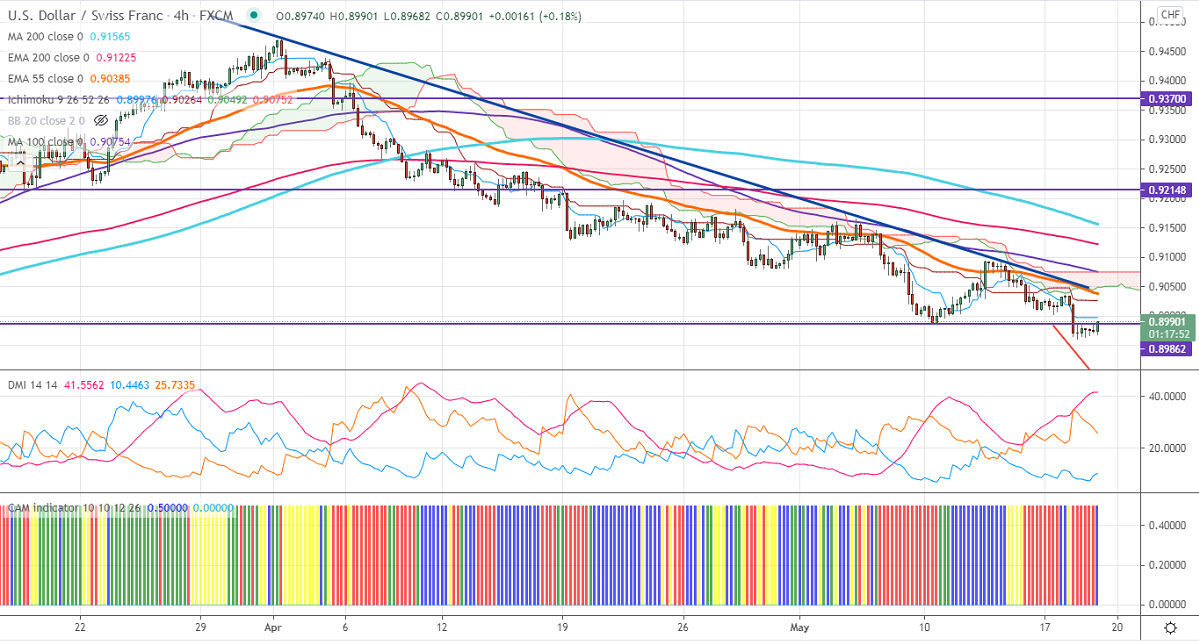

Ichimoku analysis (4-Hour chart)

Tenken-Sen- 0.89976

Kijun-Sen- 0.90268

USDCHF continues to trade weak for fifth consecutive days and holding below 0.9000 level. The dovish stance by Fed members is putting pressure on the US dollar. Markets eye US FOMC meeting minutes for further direction. The Fed is expected to maintain its dovish stance and interest rates, bond purchase unchanged. The US 10- year bond yield jumped more than 1% from an intraday low of 1.63%. The intraday trend is weak as long as resistance 0.9045 holds. The US dollar trades well below 90 levels and to retest 89.20 soon. The long-term trend is still on the downside as long as resistance 0.94725 holds.

Intraday day outlook:

Trend- Bearish

The pair is holding well below 4- H Tenken-Sen and Kijun-Sen. The near-term support is around 0.8960. Any close below 0.8960 will take the pair to next level to 0.8900/0.8835. On the higher side, near-term resistance is around 0.9000. Any breach above targets 0.9045/0.90925.

Indicator (4-Hour chart)

CAM indicator – Bearish

Directional movement index – bearish

It is good to sell on rallies around 0.8988-90 with SL around 0.9030 for a TP of 0.8900