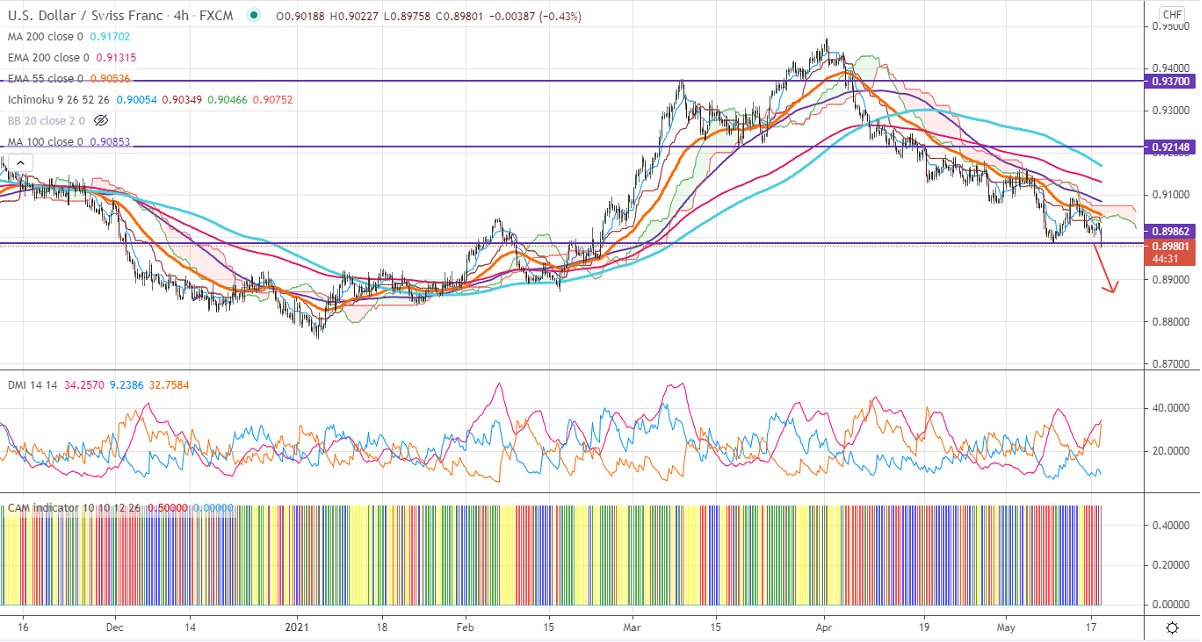

Ichimoku analysis (4-Hour chart)

Tenken-Sen- 0.90186

Kijun-Sen- 0.90481

USDCHF is trading weak and lost more than 100 pips from a temporary top around 0.90932. The broad-based US dollar selling and minor weakness in US bond yield are putting pressure on this pair at higher levels. The intraday trend is weak as long as resistance 0.9045 holds. The US dollar has broken major support at 90 and a dip till 89.69 is possible. The US empire state manufacturing index for Apr came at 24.3 vs an estimate of 23.9. The long-term trend is still on the downside as long as resistance 0.94725 holds.

Intraday day outlook:

Trend- Bearish

The pair is holding well below Tenken-Sen and Kijun-Sen. The pair has broken significant support 0.89862 and declined till 0.89752. Any close below 0.8980 will take the pair to next level to 0.8900/0.8835..91025/0.9120/0.9165. On the higher side, near-term resistance is around 0.9030. Any breach above targets 0.9045/0.90925.

Indicator (4-Hour chart)

CAM indicator – Bearish

Directional movement index – bearish

It is good to sell on rallies around 0.8925-50 with SL around 0.9030 for a TP of 0.8900