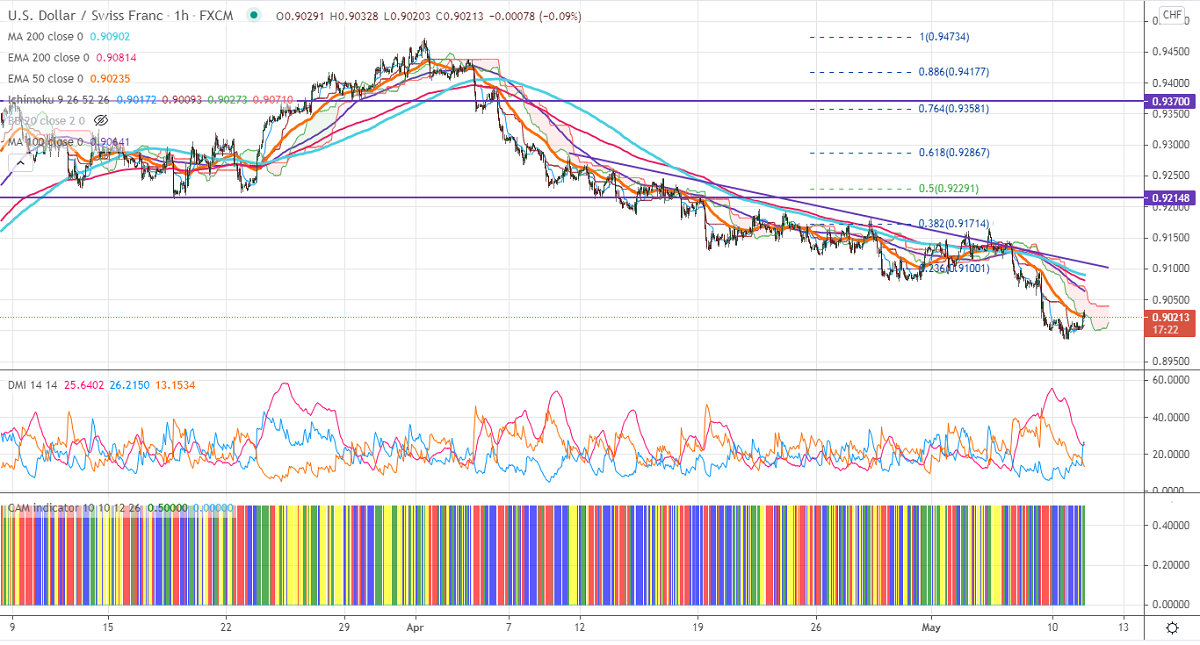

Ichimoku analysis (Hourly chart)

Tenken-Sen- 0.90159

Kijun-Sen- 0.90080

USDCHF has shown a minor recovery after a massive sell-off. The pair was one of the worst performers in the past five weeks and lost more than 5% on broad-based US dollar selling. The US dollar index continues to trade lower, any break below 90 confirms a bearish continuation. Markets eye Fed member speech today for further direction. The recovery in US bond yield is preventing USDCHF from further selling. The US 10-year bond yield surged more than 8% from minor bottom 1.48%. The intraday trend of USDCHF is still lower as long as resistance 0.9075 intact. The long-term trend is still on the downside as long as resistance 0.94725 holds.

Intraday day outlook:

Trend- Bearish

The pair is holding well below 100 and 200-H MA, this confirms bearishness. Any jump above 0.90650 will take the pair to next level to 0.9090/0.9120/0.9165. On the lower side, near-term support is around 0.8980. Any dip below that level targets 0.8870/0.8830/0.8750.

Ichimoku Analysis- The pair is trading slightly above hourly Kijun-Sen and cloud. Major bullishness only if it breaks 0.9090.

Indicator (Hourly chart)

CAM indicator – Bullish

Directional movement index – Bullish

It is good to sell on rallies around 0.90290-300 with SL around 0.9075 for a TP of 0.0.8850.