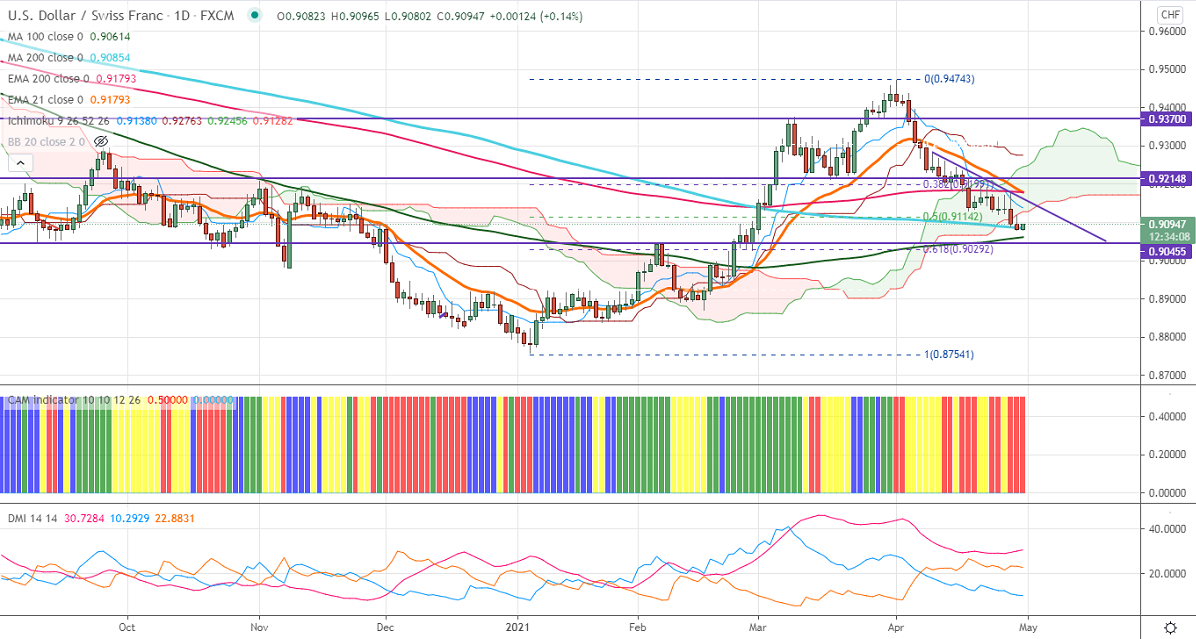

Ichimoku analysis (Daily chart)

Tenken-Sen- 0.91477

Kijun-Sen- 0.92763

USDCHF continues to trade weak for third consecutive days on broad-based US dollar selling. The US dollar index hits a fresh two-month low on upbeat market sentiment. The Real gross domestic product rose 6.4% at an annualized rate in the first quarter of 2021 compared to 4.3% in the fourth quarter. The number of people who have filed unemployment benefits declined by 13000 to 553000 vs an estimate of 540K. The intraday trend is bearish as long as resistance 0.9155 holds. The long-term trend is still on the downside as long as resistance 0.94725 holds.

Intraday day outlook:

Trend- Bearish

On the lower side, any close below 0.90860 (200- day MA) will pave the way for the pair to reach 0.9050/0.900. The pair is facing significant resistance at 0.9120; any jump above will take the pair to 0.9140/0.9155/0.9185. Minor trend continuation only if it breaks above 0.9185.

Ichimoku Analysis- The pair is trading well below daily Kijun-Sen, Tenken-Sen, and cloud. Major bullishness only if it breaks 0.9185.

Indicator (Daily chart)

CAM indicator – Bearish

Directional movement index – Bearish

It is good to sell on rallies around 0.91225-50 with SL around 0.9185 for a TP of 0.9000.