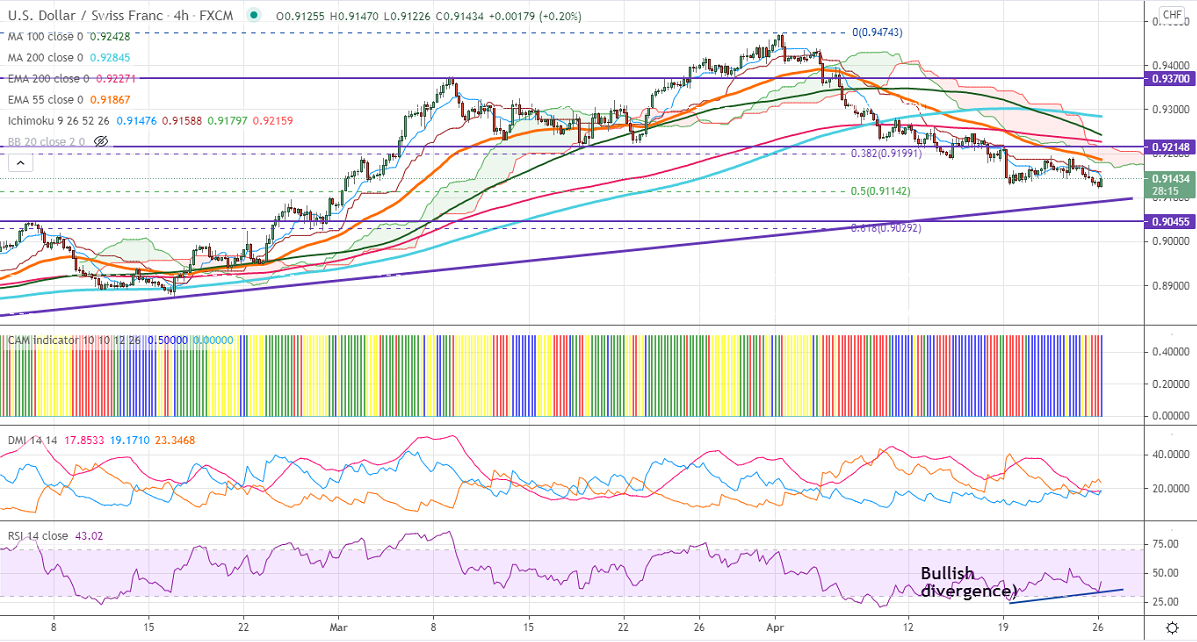

Ichimoku analysis (4-hour chart)

Tenken-Sen- 0.91566

Kijun-Sen- 0.91588

USDCHF has broken low of 0.91270 made on Apr 19th, 2021, and declined till 0.91217. This confirms the pair has formed a temporary top around 0.94725, a dip to 0.90290 (61.8% fib retracement of 0.8750 and 0.94725). The broad-based US dollar selling is putting pressure on this pair at higher levels. DXY is trading well below 91 levels; a dip to 90.20 is possible. The long-term trend is still on the downside as long as resistance 0.94725 holds. USDCHF hits an intraday high of 0.91955 and is currently trading around 0.91496.

Intraday day outlook:

Trend- Bullish

The intraday bias of the pair is slightly like to rebound till 0.91850 on bullish divergence in 4- hour RSI. On the lower side, any break below 0.9120 confirms bearish continuation, a dip till 0.9090/0.9050/0.90290 is possible. The pair is facing significant resistance at 0.91850; any jump above will take the pair to 0.92000/0.9240/0.92600/0.9300 likely. Significant bullish continuation only if it breaks 0.93700.

Ichimoku Analysis- The pair is trading below 4-hour Kijun-Sen, Tenken-Sen, and cloud. Major weakness only if it breaks 0.9095.

Indicator (Daily chart)

CAM indicator – Neutral

Directional movement index – Bearish

It is good to sell on rallies around 0.9185-88 with SL around 0.9225 for a TP of 0.9050.