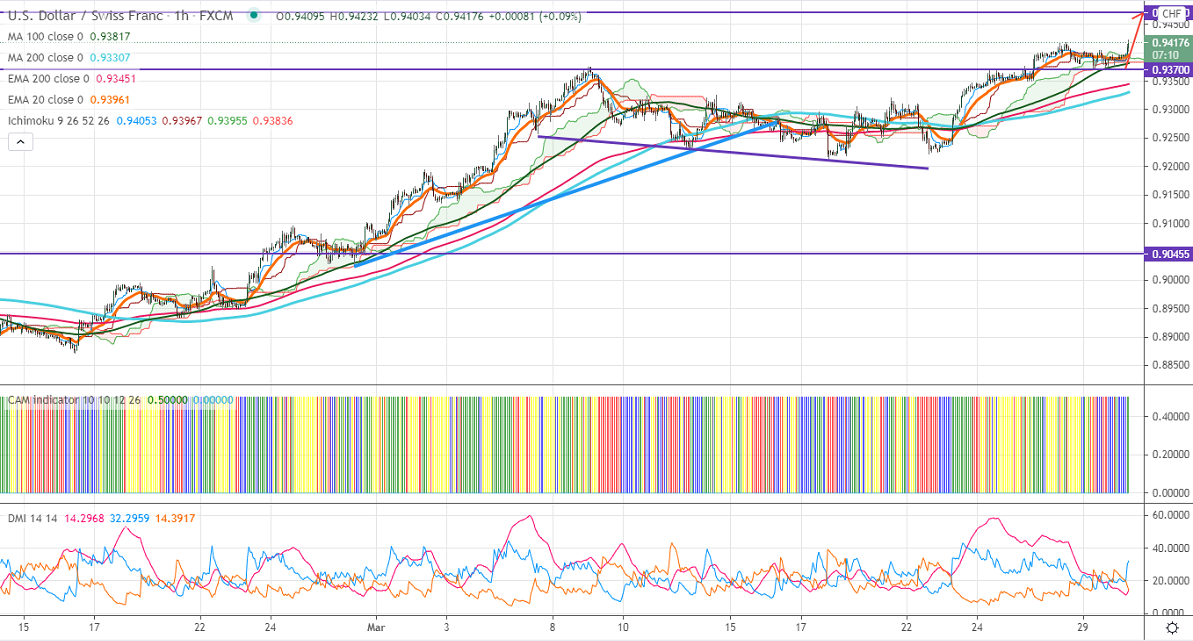

Ichimoku analysis (1-hour chart)

Tenken-Sen- 0.94005

Kijun-Sen- 0.93923

USDCHF has recovered after a minor decline to 0.93700. The pair has taken support near-horizontal resistance (resistance turned into support) and any intraday weakness only if it breaks 0.93700. The surge in US 10-year bond yield from a low of 1.65% is supporting the US dollar at lower levels. The DXY is holding well above 200- day EMA. A jump to 93.25/93.60 is possible. USDCHF hits an intraday high of 0.94154 and is currently trading around 0.94149.

The pair is facing significant resistance at 0.9420; a violation above this confirms further bullishness. A jump till 0.94502 (161.8% fib)/0.94715/0.9500. On the lower side, significant support stands at 0.9370, any indicative break below targets 0.9300/0.9260/0.9200.

Ichimoku Analysis- The pair is trading below hourly Kijun-Sen, Tenken-Sen, and cloud. Minor weakness only if it breaks 0.9350.

Indicator (1-hour chart)

CAM indicator – Bearish

Directional movement index – Bearish

It is good to buy on dips around 0.9415-17 with SL around 0.937 for a TP of 0.95000