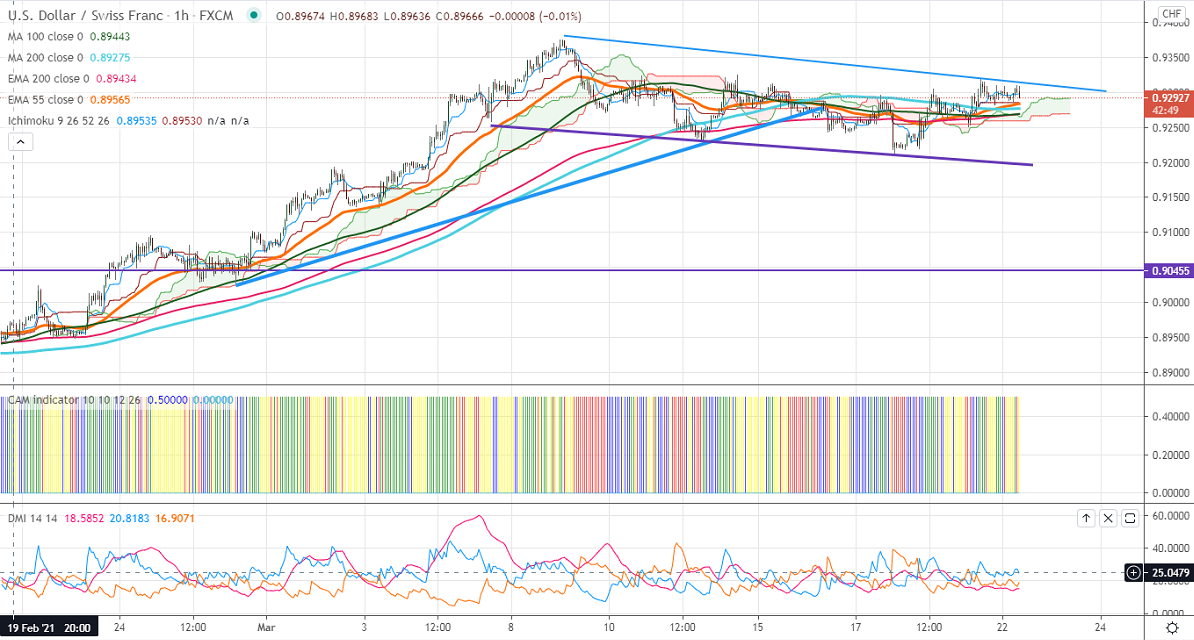

Ichimoku analysis (1-hour chart)

Tenken-Sen- 0.92978

Kijun-Sen- 0.92855

USDCHF has taken support near trend line and shown a nice recovery till 0.93195. The overall trend is still neutral as long as resistance 0.9375 holds. The US dollar is gaining strength on the surge in US bond yield. The US 10-year bond yield shown a minor profit booking of more than 3.5%. US dollar index is holding above 92 levels, any violation above 92.20 confirms bullish continuation. USDCHF hits an intraday high of 0.93089 and is currently trading around 0.93043.

The pair is facing significant resistance at 0.93250; a jump past this level confirms intraday bullishness. A jump till 0.9375 (Mar 9th, 2021)/0.94235. On the lower side, significant support stands at 0.92688 (200-H EMA), any indicative break below targets 0.9220/0.9200/0.9150/0.9100.

Ichimoku Analysis- The pair is trading slightly above Kijun-Sen, Tenken-Sen, and cloud. But it should close above 0.9325 for minor bullishness.

Indicator (4-hour chart)

CAM indicator – Neutral

Directional movement index – Neutral

It is good to buy on dips around 0.9265-68 with SL around 0.9220 for a TP of 0.9370.