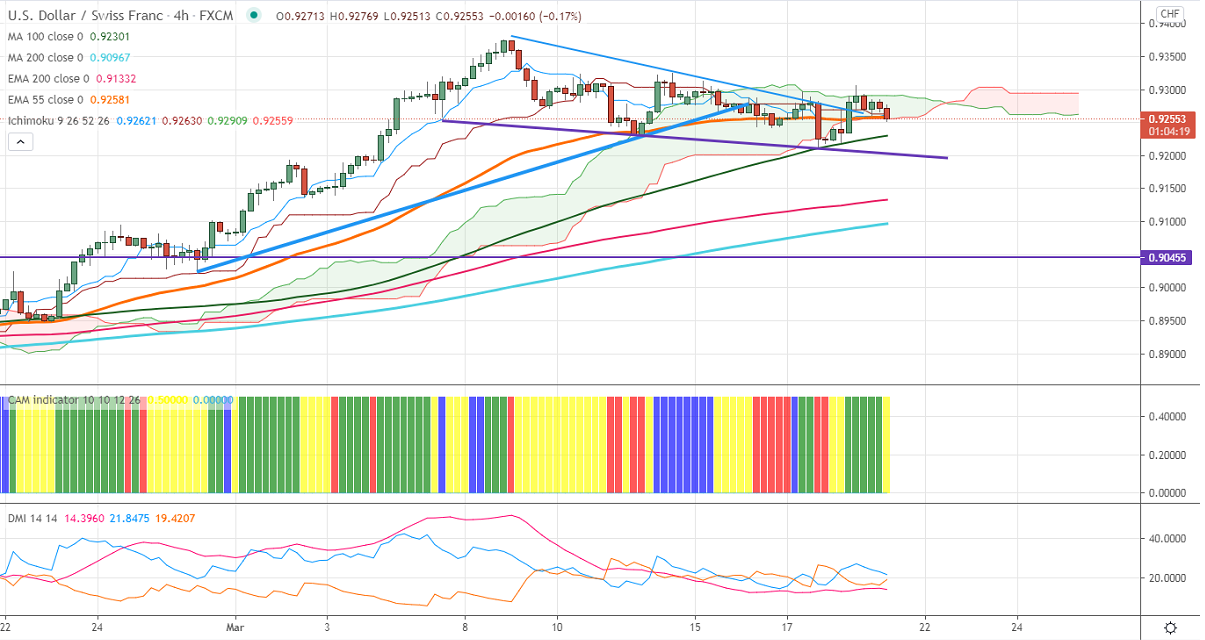

Ichimoku analysis (1-hour chart)

Tenken-Sen- 0.92594

Kijun-Sen- 0.92530

USDCHF is trading in a narrow range between 0.93251 and 0.92134 for the past five days. The surge in US bond yield and global economic recovery is supporting the US dollar at lower levels. The number of people who have filed for unemployment benefits rose to 77000 during the week ended Mar 13th. The Philly fed manufacturing index soared to 51.80 in Mar, the highest level in 50 years. The pair hits an intraday low of 0.92564 and is currently trading around 0.92580.

The pair is facing significant resistance at 0.93250, jump past this level confirms intraday bullishness. A jump till 0.9375 (Mar 9th, 2021)/0.94235. On the lower side, significant support stands at 0.9200 (channel support), any indicative break below targets 0.9180/0.9150/0.9100.

Ichimoku Analysis- The pair is trading below Kijun-Sen, Tenken-Sen, and cloud. But it should close below 0.92000 for bearish continuation.

Indicator (4-hour chart)

CAM indicator – Neutral

Directional movement index – Neutral

It is good to sell on rallies around 0.9260-625 with SL around 0.9300 for a TP of 0.9150.