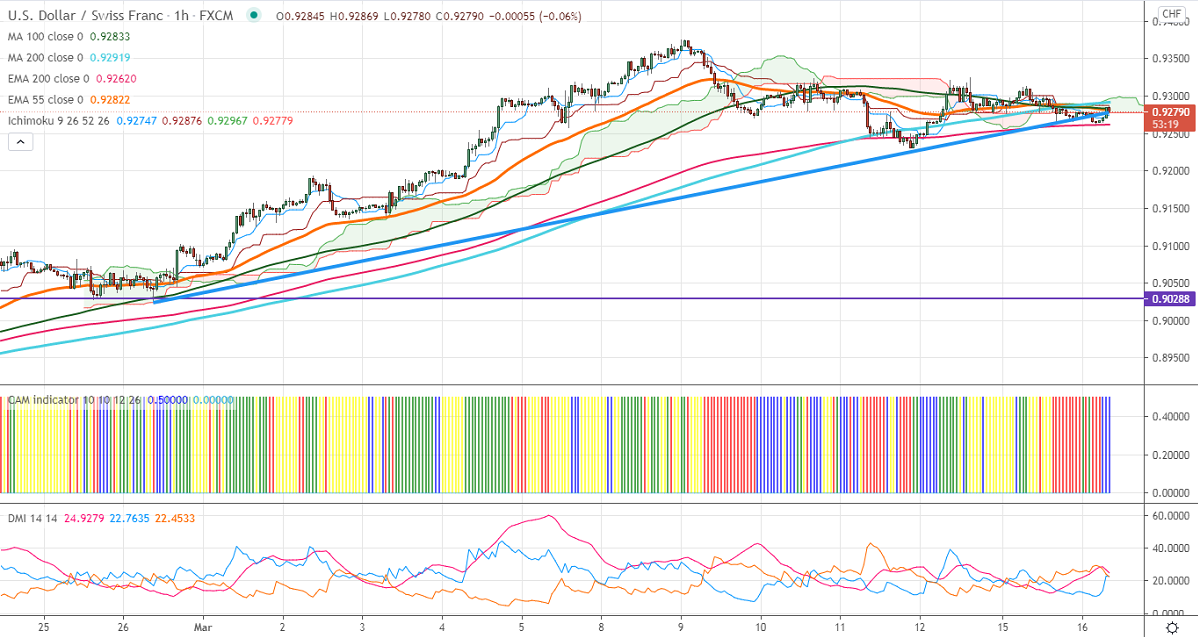

Ichimoku analysis (Hourly chart)

Tenken-Sen- 0.92706

Kijun-Sen- 0.92875

USDCHF has once again declined after a minor jump above 0.9320 levels. The slight bullish trend in the Swiss franc is putting pressure on this pair at higher levels. The minor decline in US 10- year yield is weighing on the US dollar. US Empire state manufacturing index jumped to 17.4 in Mar, hits the highest level in 8 months compared to a forecast of 12.1. Markets eye US retail sales data for further direction. The intraday trend is bearish as long as resistance 0.93250 holds. The pair hits an intraday low of 0.92625 and is currently trading around 0.92766.

The pair is facing significant resistance at 0.9325, this confirms intraday bullishness. A jump till 0.9365/0.9380. On the lower side, significant support stands at 0.9260, any indicative break below targets 0.9225/0.9180.

Ichimoku Analysis- The pair is trading below Kijun-Sen, Tenken-Sen, and cloud. But it should close below 0.92250 for bearish continuation.

Indicator (Hourly chart)

CAM indicator – Neutral

Directional movement index – Neutral

It is good to sell on rallies around 0.9285-29 with SL around 0.93250 for a TP of 0.9180.