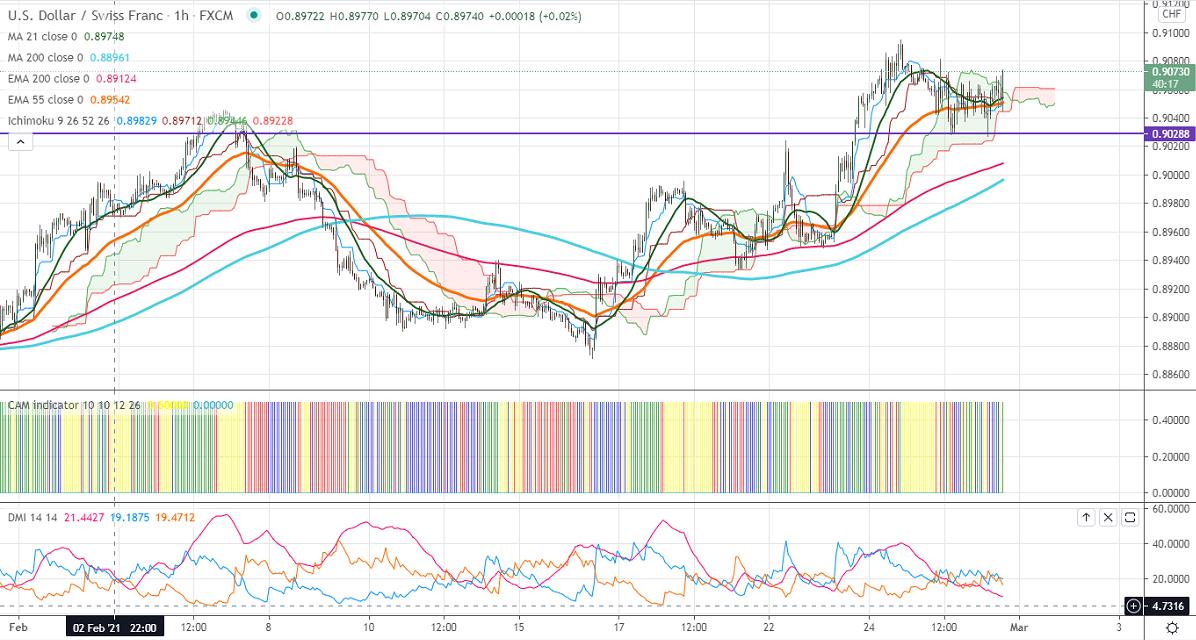

Ichimoku analysis (Hourly chart)

Tenken-Sen- 0.90482

Kijun-Sen- 0.90495

USDCHF is consolidating after hitting a high of 0.90947. The board-based US dollar buying on surging US bond yield is supporting the pair at lower levels. The US dollar index is holding well above 90 levels. any break above 90.60 confirms minor bullishness. Personal income in the US soared to 10% in Jan slightly better than the forecast of 9.5%. US Chicago PMI declined to 59.5 in Feb slightly less than the estimated 61.1.

The near-term resistance at 0.9090; any convincing violation above will take to the next level till 0.9140/0.9170/0.9200. Significant trend reversal only above 0.90450.

On the lower side, significant support stands at 0.9025, any indicative break below targets 0..9000/0.89770/0.8930.

Indicator (1-hour chart)

CAM indicator – Neutral

Directional movement index – Bullish

It is good to buy on dips around 0.9048-50 with SL around 0.9020 for a TP of 0.9148