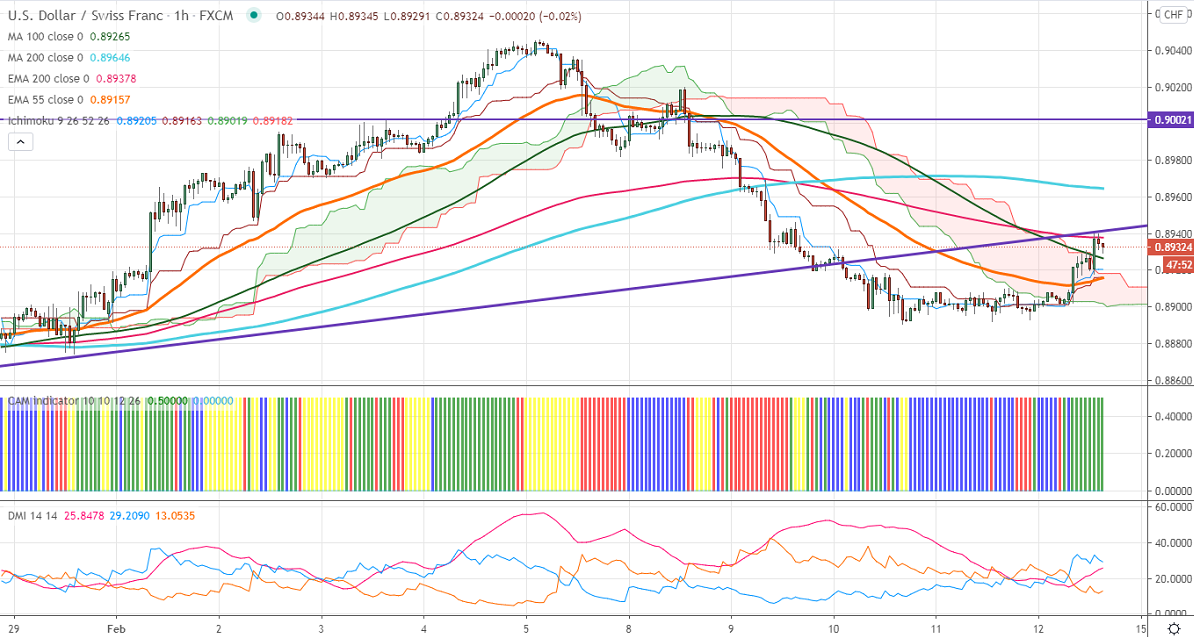

Ichimoku analysis (1-Hour chart)

Tenken-Sen- 0.89205

Kijun-Sen- 0.89159

USDCHF has formed double bottom around 0.8890 and shown a minor recovery. The pair is holding well above hourly Tenken-Sen and Kijun-Sen and is currently trading around 0.89361. The sharp jump in US10-year bond yields rose more than 3.8% is supporting the US dollar at lower levels. DXY is trading slightly higher; any violation above 91 confirms further bullishness. The University of Michigan sentiment came at 76 in Jan compared to a forecast of 80.

The near-term resistance at 0.8940; any convincing violation above will take to the next level till 0.8965 (200-H MA)/0.9000/0.9044.

On the lower side, significant support stands at 0.8890, any indicative break below targets 0.88380/0.8800/0.8750.

Indicator (1-hour chart)

CAM indicator – Bullish

Directional movement index – Bullish

It is good to buy on dips around 0.8925-28 with SL around 0.8890 for a TP of 0.0.9040.