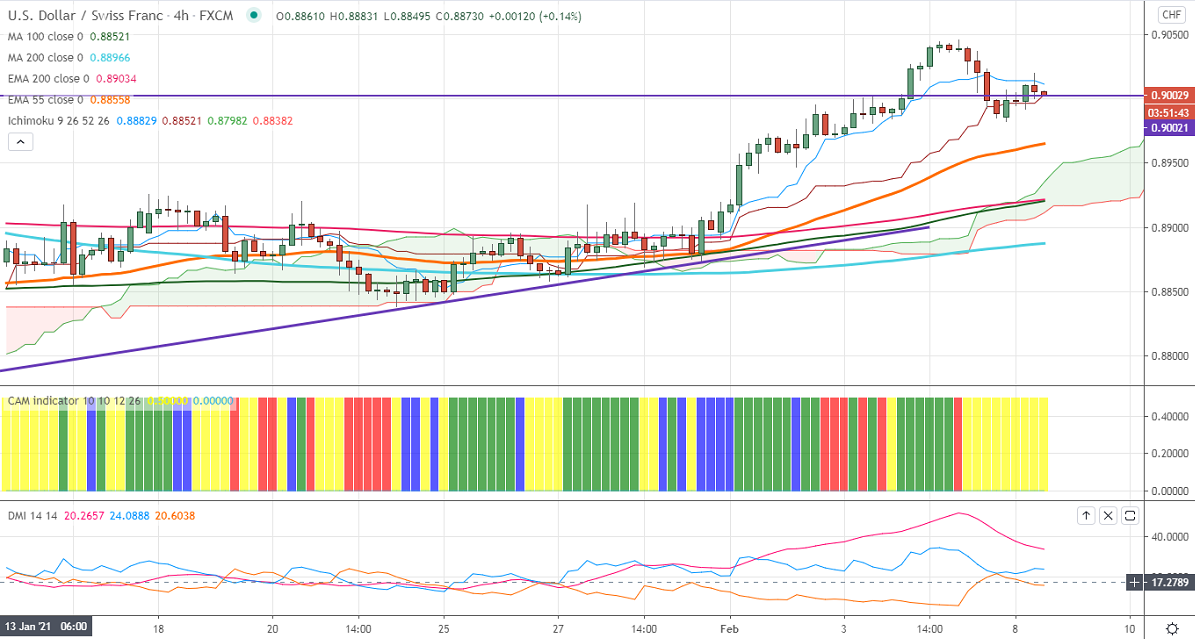

Ichimoku analysis (Daily chart)

Tenken-Sen- 0.90140

Kijun-Sen- 0.89965

USDCHF has halted its one month of the bullish trend and shown a minor profit booking. The pair was one of its best performers and surged more than 250 pips on board based US dollar buying. DXY is trading slightly lower and holding well above 91 level. The weak US nonfarm payroll data has dragged more than 50 pips from high of 91.60. US economy has added 49000 new jobs in Jan much lower than an estimate of 85K. The previous month was downward revised to -227000. The unemployment rate declined to 6.3%vs 6.7%.

The near-term resistance at 0.9050; any convincing violation above will take to the next level till 0.9080/0.91480.

On the lower side, significant support stands at 0.8980, any indicative break below targets 0.8950/0.8920/0.8870.

Indicator (4-hour chart)

CAM indicator – Neutral

Directional movement index – Neutral

It is good to buy on dips around 0.8968-70 with SL around 0.8900 for a TP of 0.9050/0.9080.