Major resistance- 0.99525

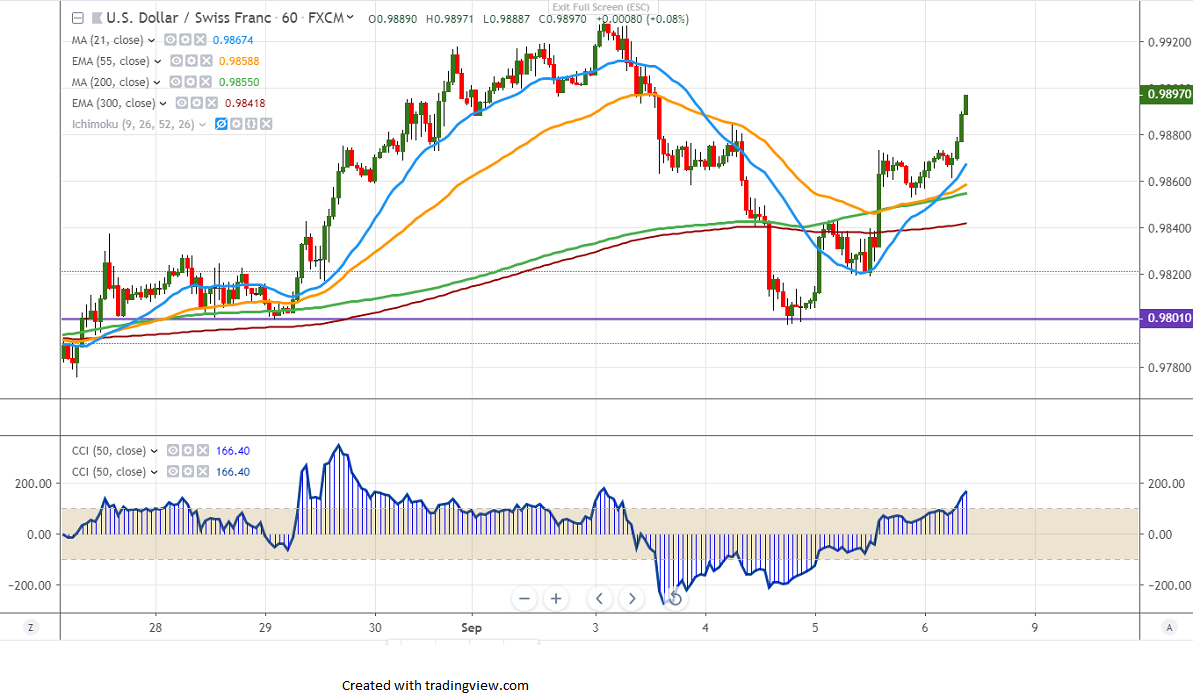

USDCHF is trading higher for the past two days and jumped nearly 90 pips on easing the US-China trade war. US bond yield recovered more than 7% on upbeat US ADP employment and ISM services PMI data. US dollar index took support near 21-day MA and shown a minor recovery. Any minor bullishness only above 98.60. It hits an intraday low of 0.98942 and is currently trading around 0.98942.

US economy is expected to add 163000 jobs in the month of Aug compared to 163K previous month, while the unemployment rate will be unchanged at 3.7% and average hourly earnings at 0.3% vs 0.3% in Jul

The near term support is around 0.9850 (200 H MA) and any violation below will drag the pair till 0.9800/0.9770/0.9715.

The decline from 1.02369 will get over at 0.9660 only if the pair closes above 0.99525 (200- day MA). The minor resistance is around 0.9905/0.99290.

It is good to buy on dips around 0.9858-60 with SL around 0.9800 for the TP of 0.9950.