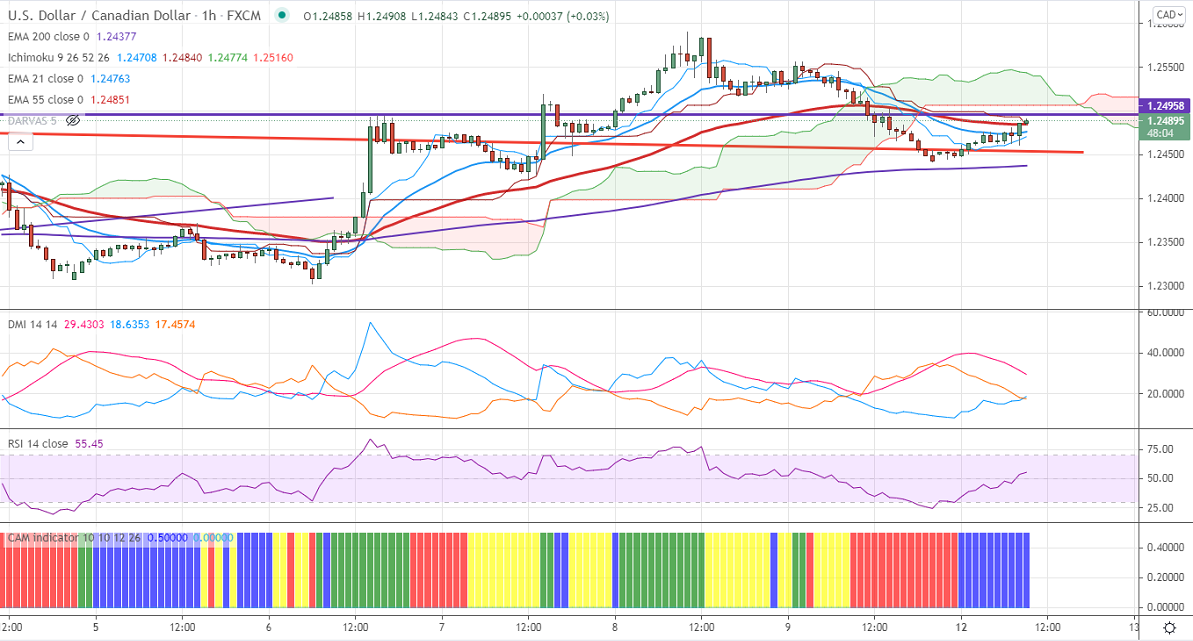

Ichimoku analysis (1-Hour chart)

Tenken-Sen- 1.24671

Kijun-Sen- 1.24934

Previous week high- 1.25902

The pair declined more than 50 pips after upbeat Canadian jobs data. The Canadian economy has added 230700 jobs in June compared to a forecast of 172500, while the unemployment rate came stead by 7.8% vs an estimate of 7.8%. surged more than 150 pips from yesterday's low of 1.24481. The minor sell-off in crude oil prices is preventing the pair from decline. It has taken support near 200-H MA and is currently trading around 1.24853.

Trend –Bullish

The near-term resistance is around 1.24850, a breach above targets 1.25350/1.2590/1.2660. On the lower side, immediate support stands around 1.2435; violation below will take the pair down to the next level 1.2400/1.2360.

It is good to buy on dips around 1.2450 with SL around 1.2400 for TP of 1.25880.