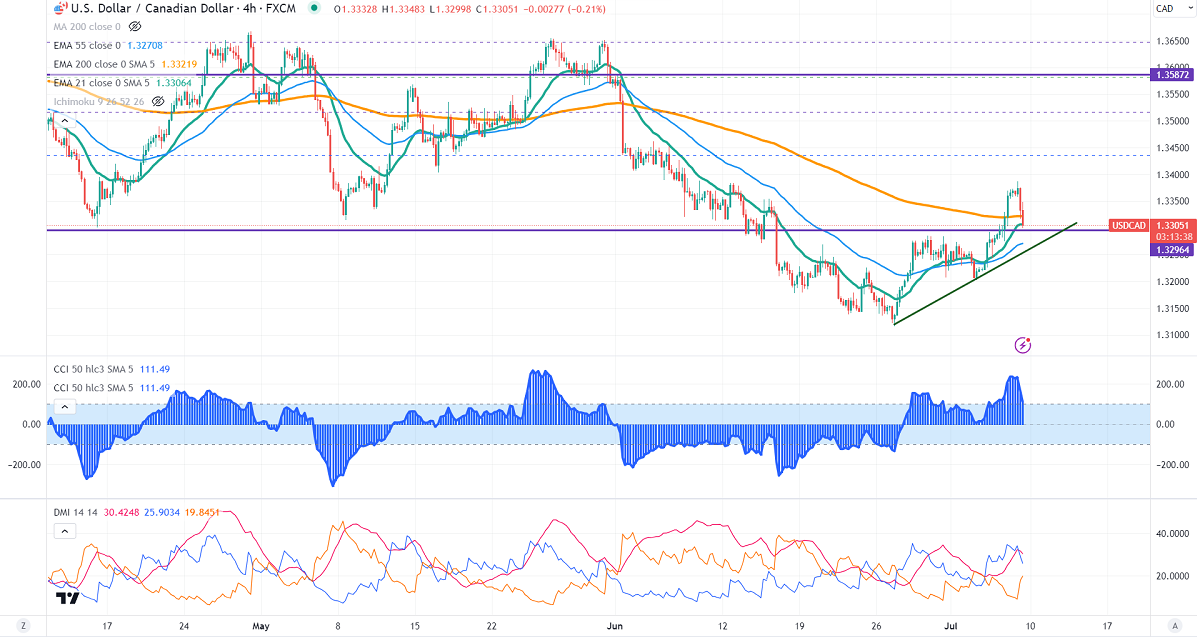

Intraday trend- Bearish

Significant support- 1.3298

USDCAD lost its shine after strong Canadian jobs data. The Canadian economy has added 59000 jobs, compared to a forecast of 19800. The unemployment rate jumped to 5.4% in June vs 5.3%. It hits an intraday low of 1.33049 and is currently trading around 1.33043.

Technically in the 4-hour chart, the pair is holding above below short-term (21- and 55 EMA) and 200 EMA (1.33221). Any break below 1.3300 will take the pair to 1.3260/1.3200.

The near-term resistance is around 1.3320 and any breach above targets is 1.3380/1.3435.

Indicators (4 Hour chart)

CCI (50)- Bullish

ADX- Neutral

It is good to sell on rallies around 1.3328-30 with SL around 1.3380 for a TP of 1.3220.