Intraday bias - Neutral

USDCAD pared some of its gains made during the European session after jobs data. The US economy has added 311000 jobs in Feb from the previous month's 517000, above the estimate of 225000. The unemployment rate increased to 3.6% from 3.4%. The US dollar lost its shine after a surge in the unemployment rate. It hits a low of 1.37667 at the time of writing and is currently trading around 1.37865.

The Canadian economy added 21800 jobs in Feb well above economists' forecast of 85000. The unemployment rate dropped to 5%.

According to the CME Fed watch tool, the probability of a 50 bpbs rate hike in Mar surged to 49.8% from 68.3% a week ago.

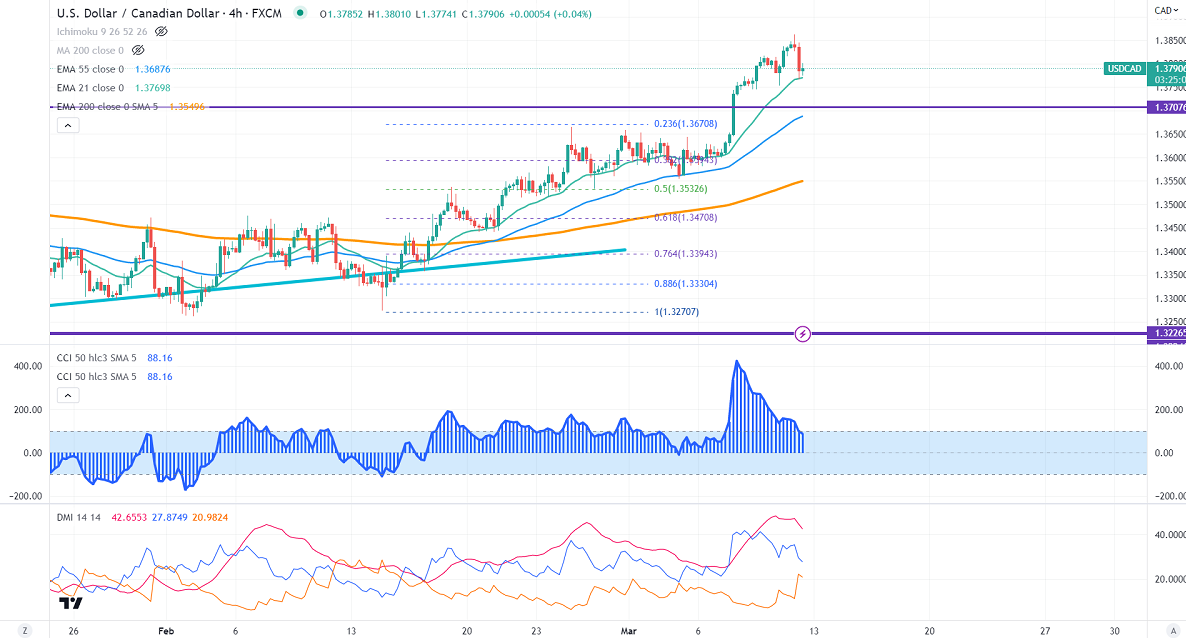

Technically in the 4-Hour chart, the pair is holding above the short-term( 21- EMA), 55 EMA, and the long-term moving average of 1.35447 (200- EMA). Any violation above 1.3865 confirms further bullishness. A jump to 1.3900/1.4000 is possible.

WTI crude oil is trading lower for the fifth consecutive day on rate hike fears. Any daily close below $75 confirms minor weakness.

The near-term support is around 1.3760 and any breach below targets is 1.3700/1.3650.

Indicators (4-Hour chart)

CCI (50)- Bullish

ADX- Neutral

It is good to buy on dips around 1.3750 with SL around 1.3700 for a TP of 1.3850.