Intraday bias - Bullish

USDCAD recovered sharply after weak Canadian economic data. Canada's Consumer price index rose 5.9% YoY, below expectations of 6.1%. Core CPI which excludes food and energy prices declined to 5% on yearly basis from 5.4% in Dec. Retail sales in Canada rose to 0.50% in Dec, in line with the estimate. It hits a low of 1.33297 and is currently trading around 1.33405.

According to the CME Fed watch tool, the probability of a 50 bpbs rate hike in Mar jumped to 21% from 18.1% a week ago.

The US 10-year yield hits a multi-week high ahead of FOMC meeting minutes. The US 10 and 2-year spread narrowed to -73.30 basis points from -88% bpbs.

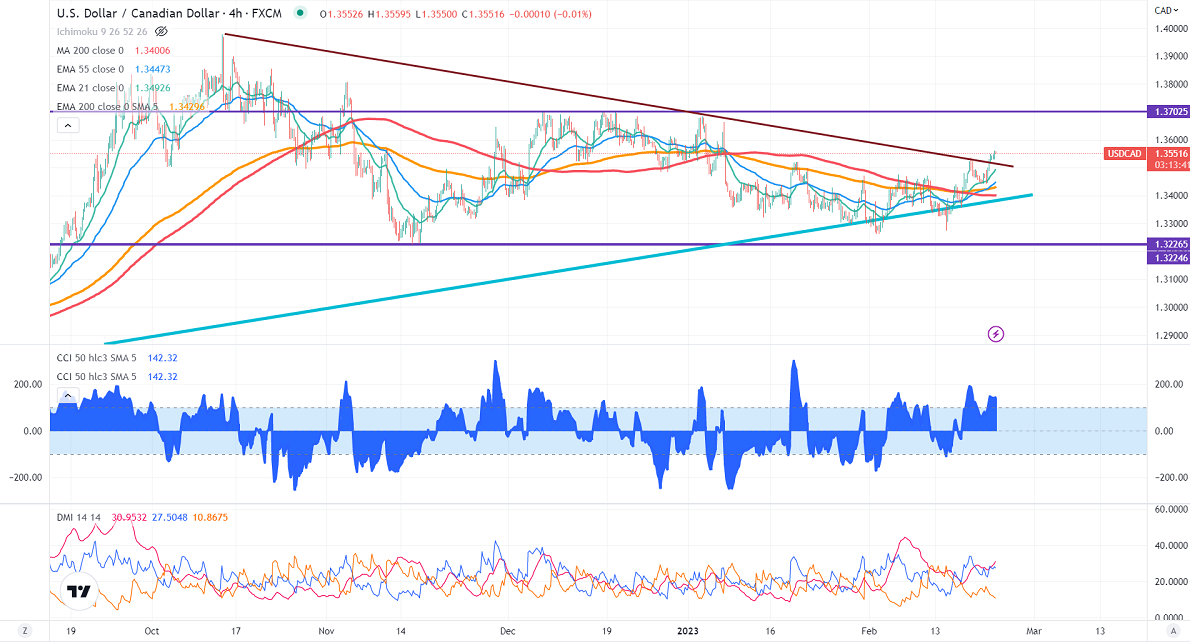

Technically in the 4-Hour chart, the pair is holding above the short-term( 21- EMA), 55 EMA, and the long-term moving average of 1.34284 (200- EMA). Any violation below 1.3500 confirms intraday bearishness. A dip to 1.3470/1.3435 is possible.

WTI crude oil declined on global economic growth concerns. Any weekly close below $73 will drag the oil prices down to $66.

The near-term resistance is around 1.35600 and any breach above targets is 1.3600/1.36800.

Indicators (4-Hour chart)

CCI (50)- Bullish

ADX- Bullish

It is good to buy on dips around 1.35250 with SL around 1.3470 for a TP of 1.36800.