Intraday bias - Neutral

USDCAD pared some of its gains despite the weak US dollar. Canadian retail sales MoM came at 1.4% in Nov, up from -0.60% the previous month. Core retail sales which exclude gasoline stations and motor vehicle and parts dealers surged to 1.7% vs the forecast of 1.3%. Markets eye US CB consumer confidence and Canadian CPI for further direction. It hits an intraday low of 1.35890 and is currently trading around 1.36100.

According to the CME Fed watch tool, the probability of a 50 bpbs rate hike in Dec rose to 70% from 57.3% a week ago.

The US 10-year yield traded higher for the third consecutive day. The US 10 and 2-year spread narrowed to -55 basis points from -85 bpbs.

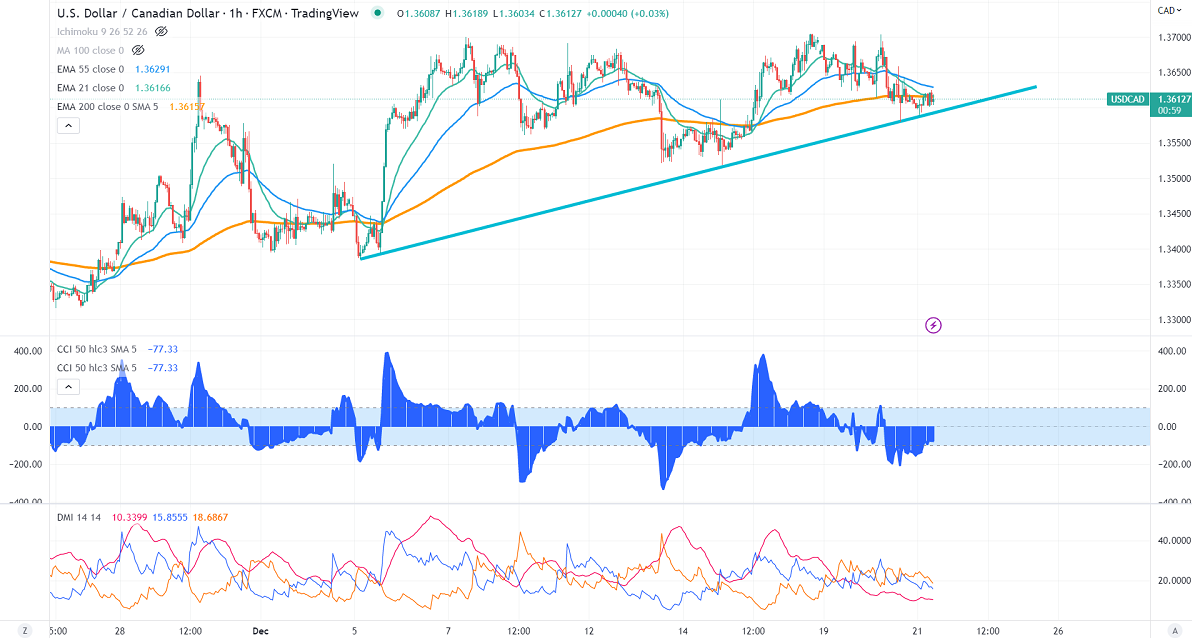

Technically in the 4-Hour chart, the pair is holding below the short-term( 21- EMA), 55 EMA, and above the long-term moving average of 1.35435 (200- EMA). Any violation below 1.3570 confirms further bearishness. A dip to 1.3500/1.34000 is possible.

WTI crude oil jumped nearly $1.5 after upbeat API inventory data. The renewed spread of COVID across the globe putting pressure on oil at higher levels. Any break above $77 will push oil prices up to $80.

The near-term resistance is around 1.3660 and any breach above targets is 1.3725/1.3800.

Indicators (4-Hour chart)

CCI (50)- Bearish

ADX- Neutral

It is good to buy on dips around 1.3570 with SL around 1.3500 for a TP of 1.3700.