Intraday bias - Bullish

USDCAD is trading lower for the second consecutive day and lost more than 150 pips on the weak US dollar. The Canadian dollar gained momentum after the 75 bpbs hawkish rate hike by the Bank of Canada on Wednesday. Markets eye Canada employment data for further direction.

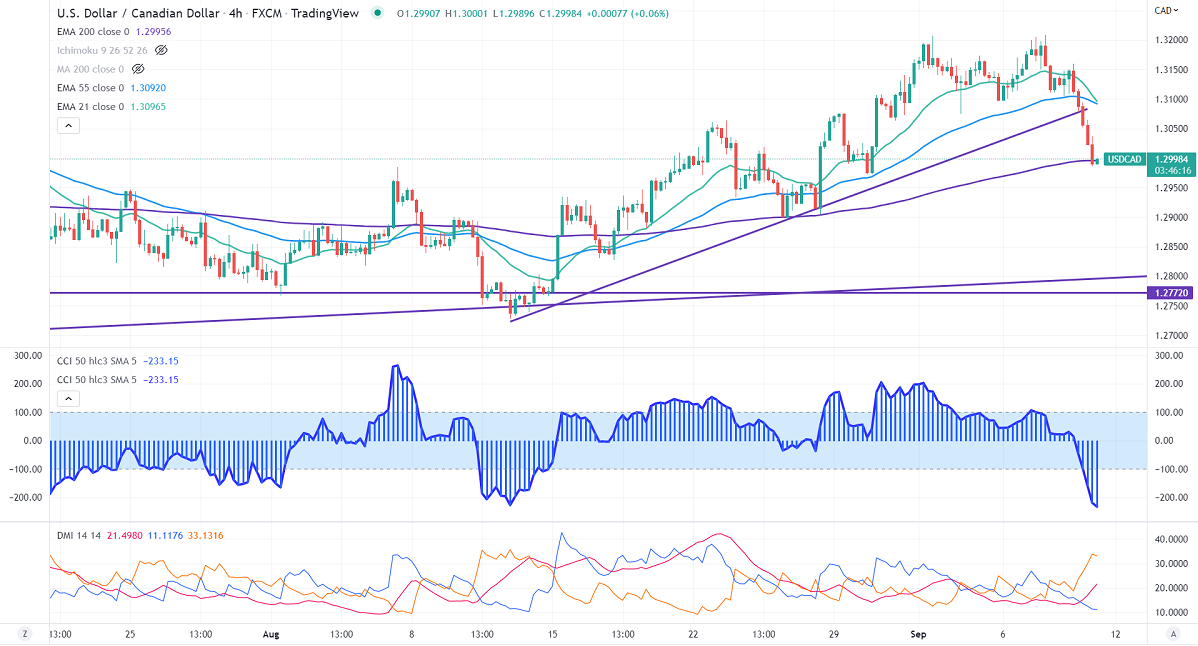

Technically in the 4-Hour chart, the pair is holding below the short-term( 21- EMA), 55- EMA, and above the long-term moving average of 200 EMA (1.29956). Any violation below 1.29700 confirms further bearishness. A decline to 1.2925/1.2880 is possible. USDCAD hits an intraday low of 1.29864 and is currently trading around 1.29940.

WTI crude oil recovered slightly from a low on short covering. Any breach below $81.50 confirms further bearishness.

The near-term resistance is around 1.3020, and any breach above targets 1.3070/1.3148/1.3220.

Indicators (4 Hour chart)

CCI (50)- Bearish

ADX- Bearish

It is good to buy on dips around 1.3070 with SL around 1.3000 for TP of 1.3220/1.3300.