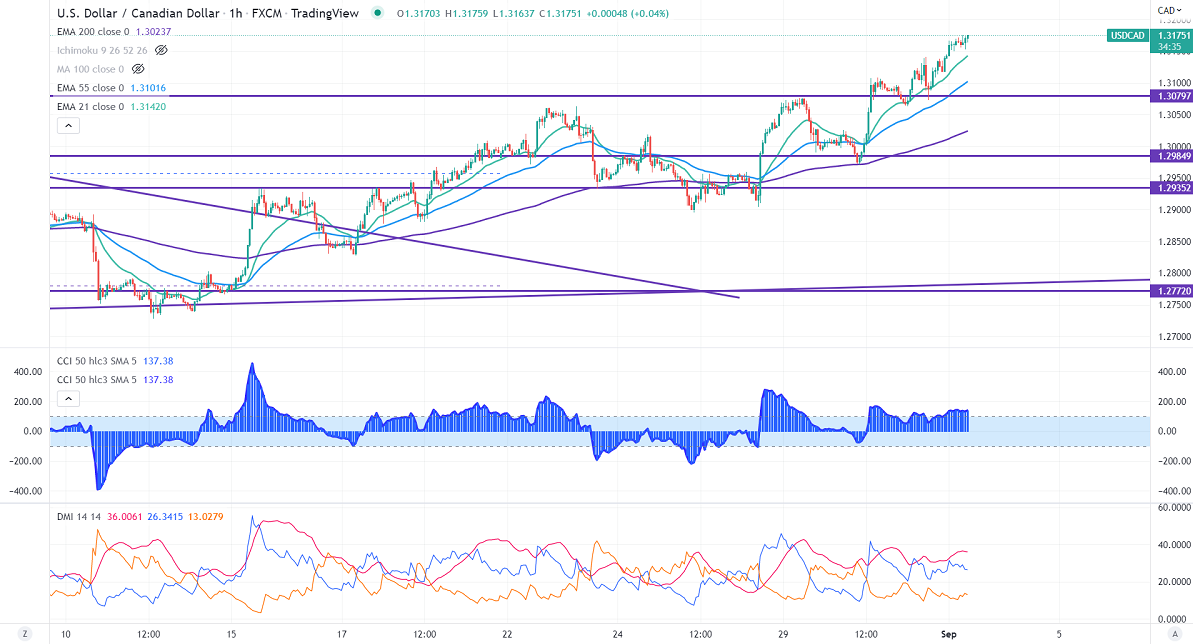

Intraday bias - Bullish

USDCAD surged sharply after a minor sell-off. The board-based US dollar buying and weak Crude oil prices drag the Canadian dollar further lower. Canadian GDP for Q2 came at 3.3% annualized compared to an estimate of 4.4%. US private payrolls have added 132000 jobs in Aug below expectations of 300000. Markets eye US ISM manufacturing PMI for further direction.

Technically in the 4-Hour chart, the pair is holding above the short-term( 21- EMA), 55- EMA, and the long-term moving average of 200 EMA (1.29096). Any jump above 1.3180 confirms a bullish continuation. A jump to 1.3220/1.3300 is possible. USDCAD hits a high of 1.31752 and is currently trading around 1.31655.

WTI crude oil pared most of its gains made the previous week on recession fears. Any breach below $86 confirms further bearishness.

The near-term support is around 1.3150, and any breach below targets 1.310/1.3070/1.3020.

Indicators (4 Hour chart)

CCI (50)- Bullish

ADX- Bullish

It is good to buy on dips around 1.3148-50 with SL around 1.310 for TP of 1.3300.

a