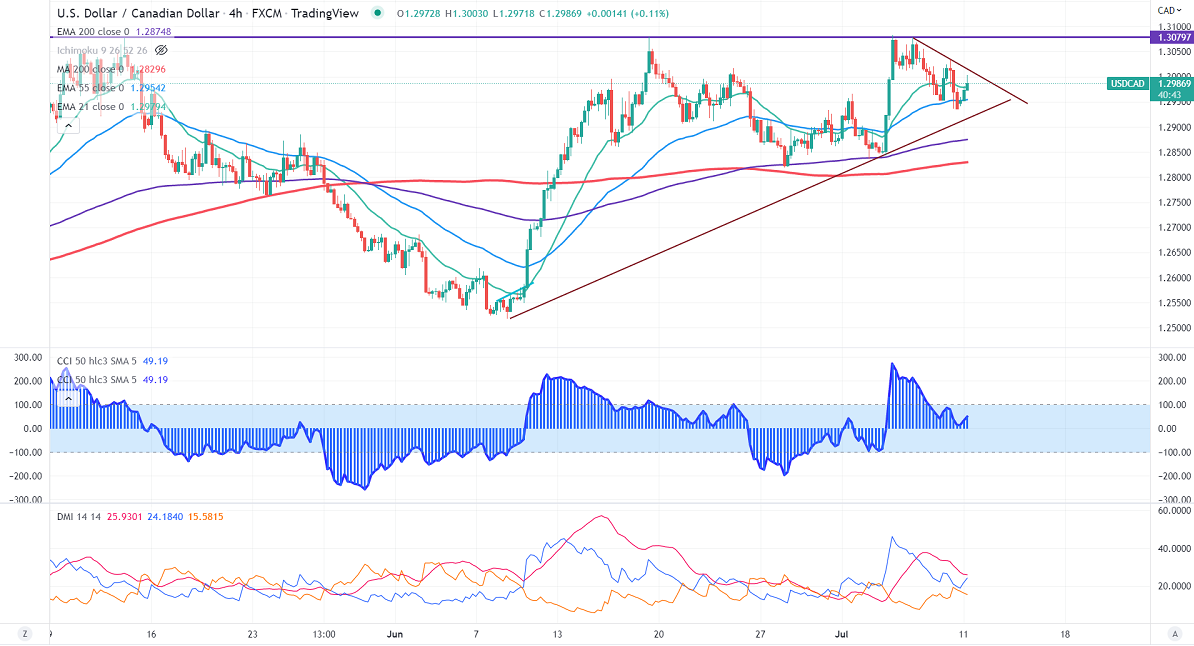

FxWirePro- USDCAD Daily Outlook

Intraday bias - Bullish

USDCAD regained above 1.3000 on board-based US dollar buying and weak Canadian employment data. The Canadian economy lost 42000 jobs in June compared to a forecast of 20000 and the unemployment rate dropped from 4.9% to 5.1%. The US dollar index regained momentum after a minor sell-off from a 19-year high. Technically in the 4 -Hour chart, the pair is holding below the short-term( 21- EMA), above 55- EMA, and the long-term moving average of 200 EMA (1.28736). Any violation below 1.2920 confirms the intraday bearish trend. A dip to 1.2865/1.2800 is possible. USDCAD hits an intraday high of 1.30030 and is currently trading around 1.29835.

WTI crude oil price dropped from a minor top of $105.13 on recession worries. Any breach above $105.20 confirms further bullishness.

The near-term resistance is around 1.3000, any breach above targets 1.3025/1.3085.

Indicators (4 Hour chart)

CCI (50)- Bullish

ADX- bullish

It is good to buy on dips around 1.2960 with SL around 1.2920 for TP of 1.3080.