Significant Support - 1.2780

USDCAD is trading weak for the fourth consecutive day on surging crude oil prices. Markets eye US retail sales for further direction. Canadian manufacturing sales rose by 2.5% m/m in Mar compared to the forecast of 2.1%. USDCAD hits a low of 1.28130 at the time of writing and currently trading around 1.28294.

Technical:

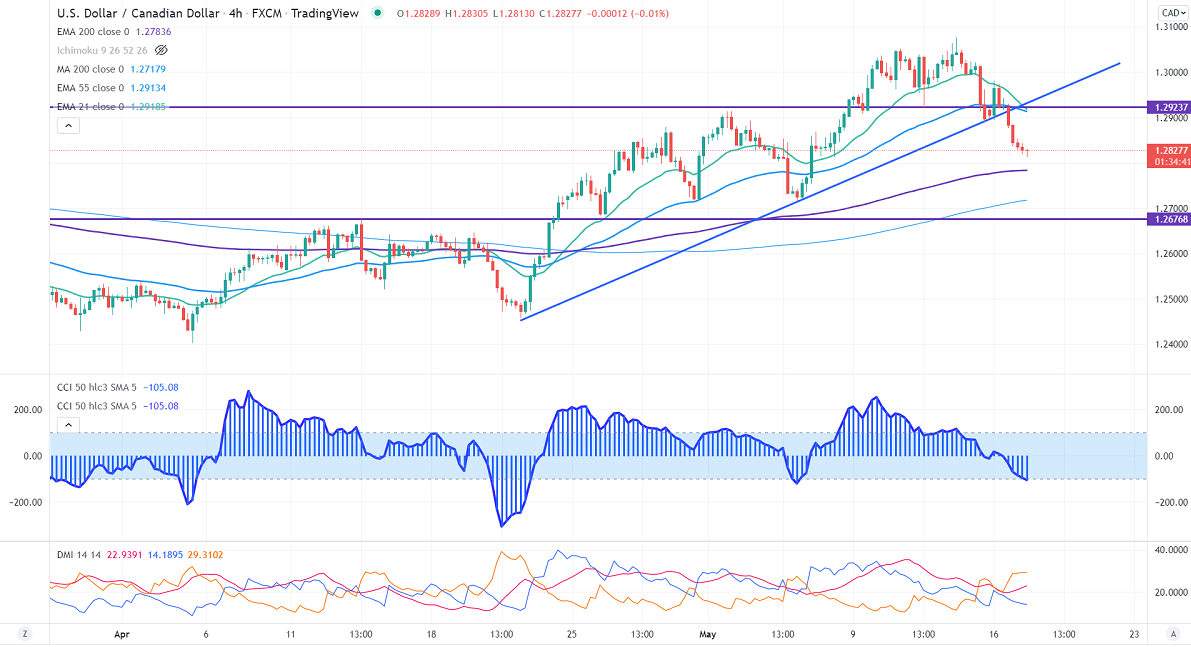

USDCAD is holding below short-term (21 EMA), medium-term (55 EMA), and above long-term ( 200 MA) 1.27835 in the 4-hour chart.

ADX- bearish

CCI (50) below zero line in the 4-hour chart.

Resistance to be watched- 1.2860, 1.2920, and 1.3000.

Support- 1.2780, 1.2720, and 1.2660.

It is good to sell on rallies around 1.2848-50 with SL around 1.2920 for a TP of 1.2660.