Significant Resistance - 1.2660

USDCAD breaks significant resistance 200-4H EMA and holds above that level. The board-based US dollar buying in hopes of an aggressive rate hike by the Fed is supporting prices at lower levels. Markets eye US CPI data and Bank of Canada monetary policy for further direction. USDCAD hits an intraday high of 1.26609 and currently trading around 1.26596.

Technical:

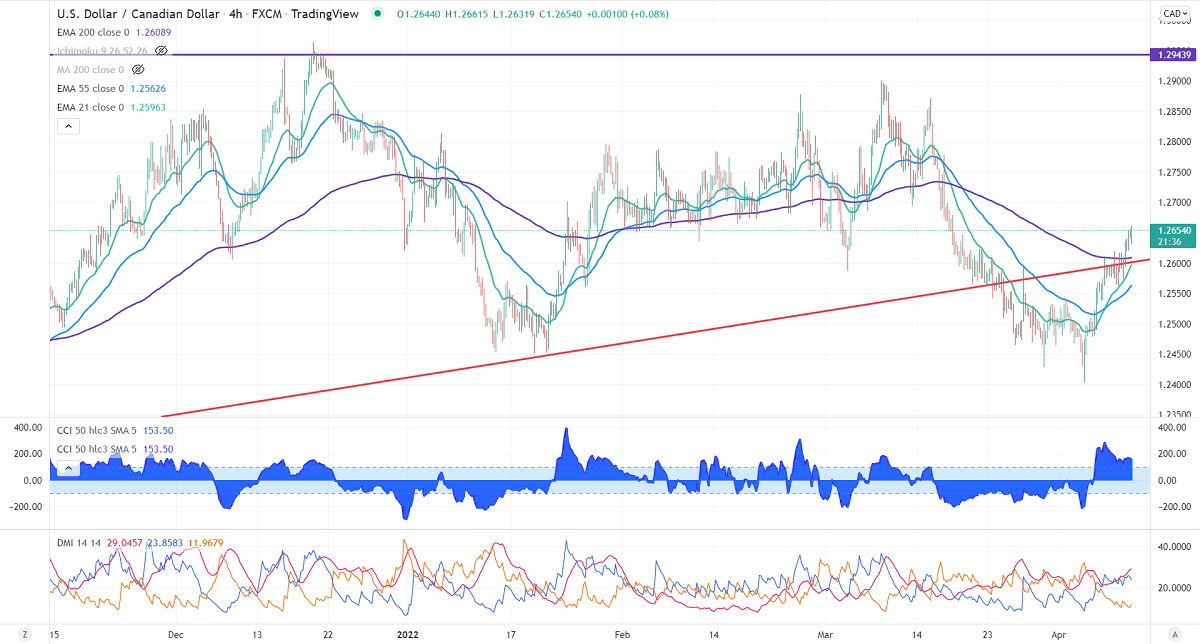

USDCAD is holding above short-term (21 EMA), medium-term (55 EMA), and below long-term ( 200 EMA) in the 4-hour chart.

ADX- Bullish

CCI (50) above zero line in the 4-hour chart.

Resistance to be watched- 1.2660, 1.2700, and 1.2760.

Support- 1.2590, 1.2550, and 1.2500.

It is good to buy on dips around 1.2638-40 with SL around 1.2600 for a TP of 1.2750.