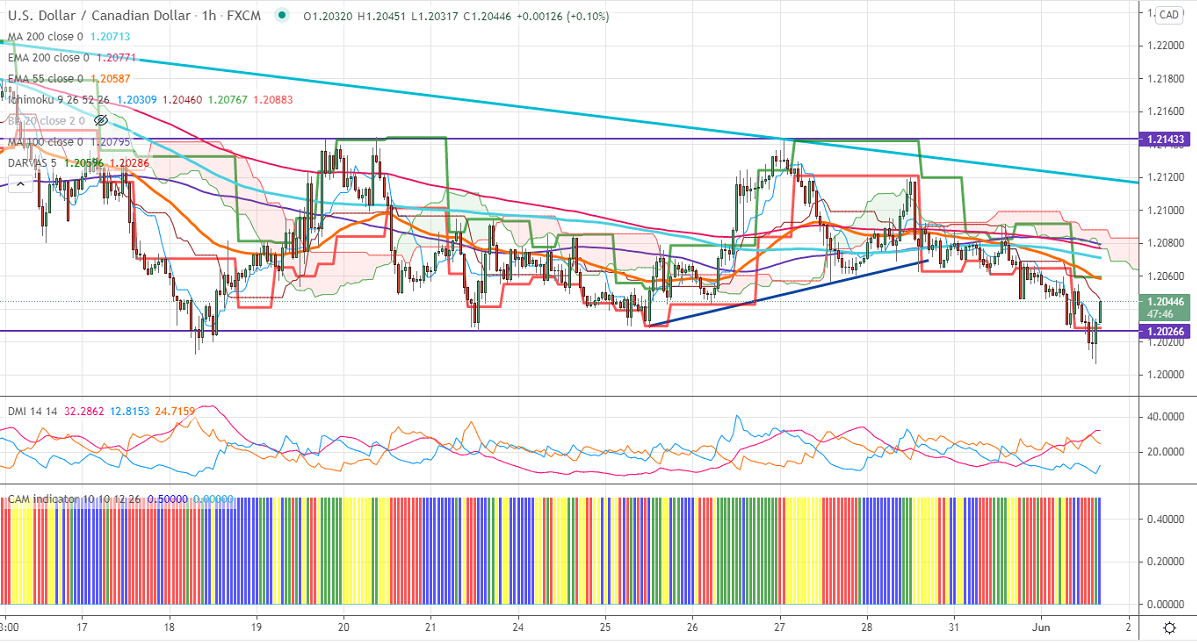

Ichimoku analysis (1-Hour Chart)

Tenken-Sen- 1.20309

Kijun-Sen- 1.20494

USDCAD continues to trade weak despite upbeat US data is. The US ISM manufacturing index rose to 61.2 in May compared to a forecast of 60. The construction spending rose 0.2% less than expected in Apr after surging 1% in Mar. The US 10-year yield raised more than 4% from an intraday low of 1.610%. Loonie hits an intraday low of 1.20069 and is currently trading around 1.20415.

WTI crude oil lost more than $1 on profit-booking from a fresh year high. The short-term trend is bullish as long as support $61.50 holds.

Technically, the pair faces near-term resistance at 1.2060. Any indicative break above will take till 1.2080/1.2120/1.2150. Minor trend continuation only above 1.2205. The significant support is around 1.2000. Any violation below will take to the next level to 1.1970/1.1950.

Indicator (1-hour chart)

CAM indicator – Bullish

D4irectional movement index –Bullish

It is good to sell on rallies around 1.2020 with SL around 1.2000 for a TP of 1.2150.