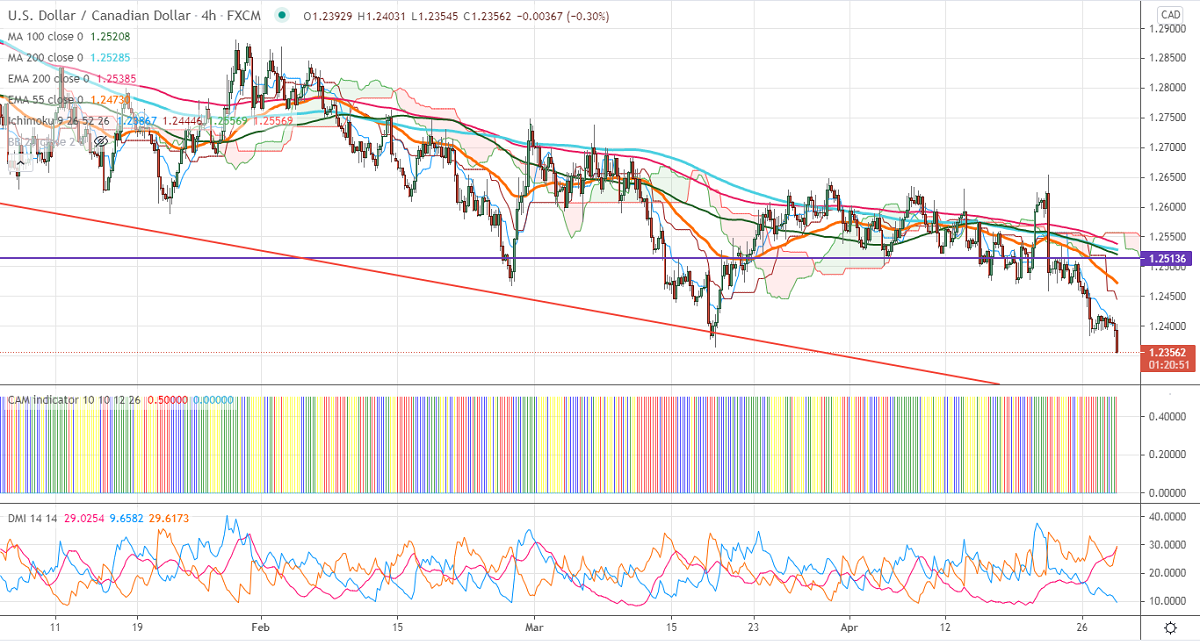

Ichimoku analysis (4-Hour Chart)

Tenken-Sen- 1.2400

Kijun-Sen- 1.24585

USDCAD continues to trade weak after upbeat Canadian retail sales. It has jumped up 4.8% in Feb compared to a forecast of 4.0%. The surge was led by gains in autos, gasoline. Markets eye US Fed FOMC statement for further direction. The central bank has kept its rates unchanged and maintain its $120bn bond-buying programs. The rally in steel, aluminum, and copper prices is supporting the Canadian dollar. The US dollar index is struggling to close above 91 levels. Any break above 91.25 confirms intraday bullishness. USDCAD hits an intraday low of 1.23547 and is currently trading around 1.23621.

WTI crude oil surged higher after EIA reported a small crude build-up. The inventory came at 100000 barrels for the week ended Apr 23. The short-term trend is bullish as long as support $60.50 holds.

Technically, the pair faces near-term resistance at 1.23850. Any indicative break above will take till 1.2425/1.2460. Major trend continuation only above 1.2660. The significant support is around 1.2350; an indicative violation below will take to the 1.2325/1.2300.

Indicator (4-hour chart)

CAM indicator – Bearish

Directional movement index –Bearish

It is good to sell on rallies around 1.2378-80 with SL around 1.2420 for a TP of 1.2300.