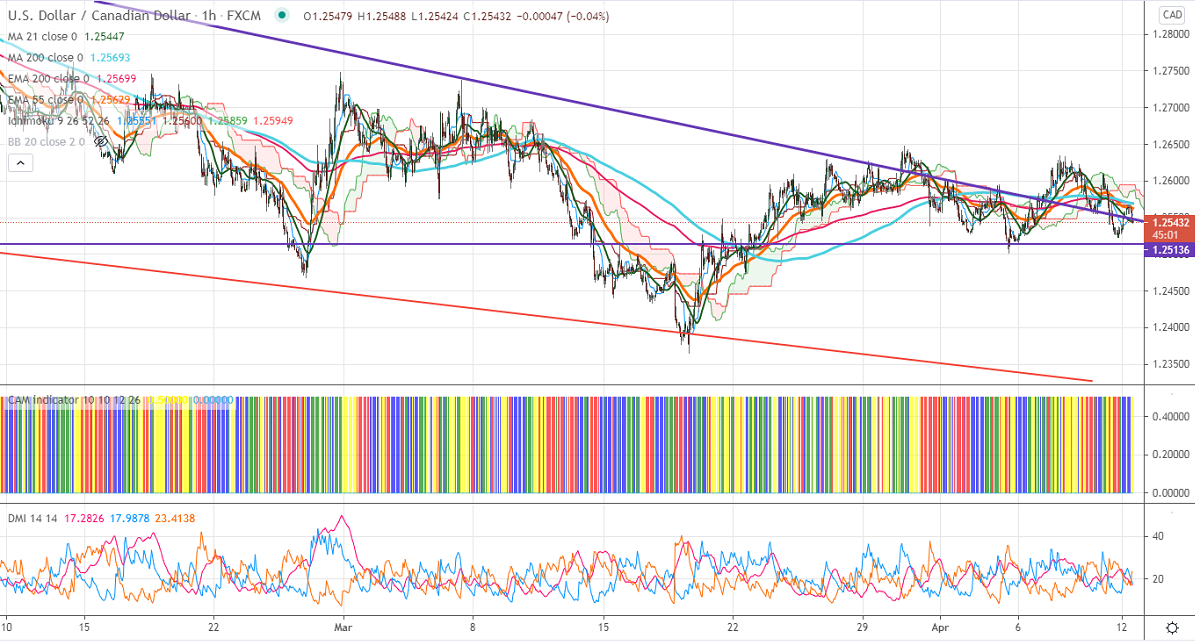

Ichimoku analysis (4-Hour Chart)

Tenken-Sen- 1.25509

Kijun-Sen- 1.25632

USDCAD is trading in a narrow range between 1.26346 and 1.5233 for the past four days. The slight weakness in the US dollar is putting pressure on this pair at higher levels. DXY's short-term trend is on the lower side, any break below 91.80 confirms a bearish continuation. The Canadian economy has added 303100 jobs in Mar compared to the forecast of 101.5k and unemployment declined to 7.5%.

WTI crude oil is consolidating for the past week. The spread of the third wave of the corona is putting pressure on crude oil prices. The short-term trend is bearish as long as resistance $62 holds.

Technically, the pair faces near-term resistance at 1.2570. Any indicative break above will take till 1.2600/1.2660. The significant support is around 1.2500; an indicative violation below will take to the 1.2460/1.2435.

Indicator (4-hour chart)

CAM indicator – Neutral

Directional movement index –Bearish

It is good to sell on rallies around 1.2598-60 with SL around 1.2650 for a TP of 1.2460.