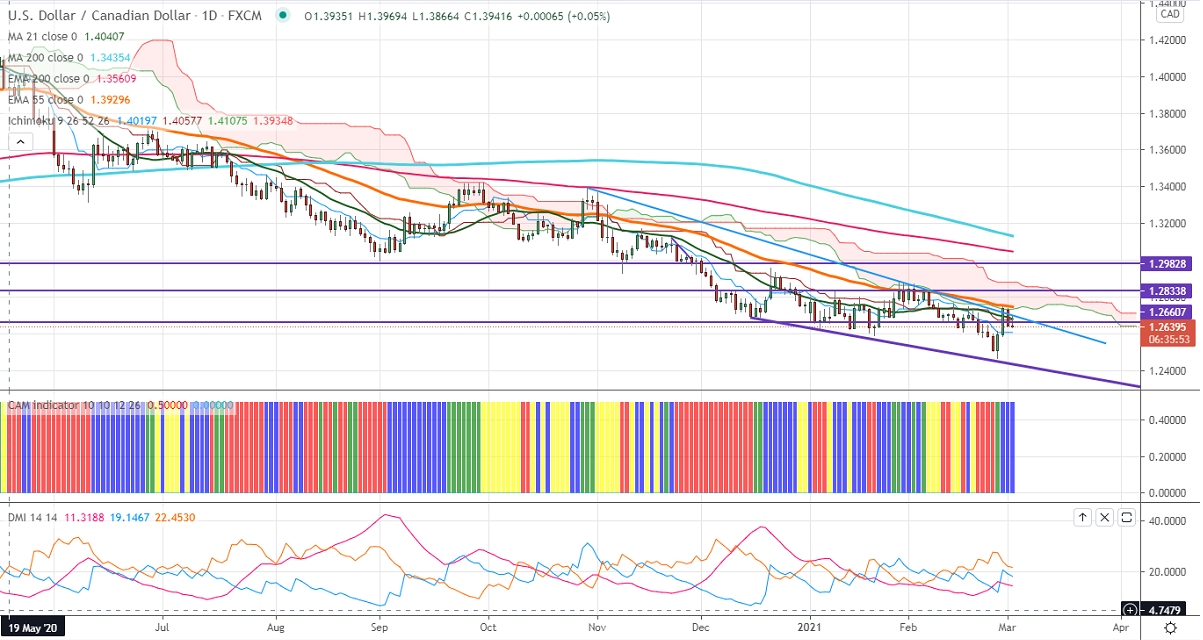

Ichimoku analysis (Daily Chart)

Tenken-Sen- 1.26079

Kijun-Sen- 1.26747

USDCAD has taken support near trend line support and jumped more than 250 pips on broad-based US dollar buying. The upbeat market sentiment and surge in crude oil prices are supporting the Canadian dollar. The Canadian GDP came at a 9.6% annualized rate in the fourth quarter compared to a forecast of 7.43%. USDCAD hits an intraday high of 1.26982 and currently trading around 1.26466.

WTI crude oil declined more than $4 in hopes of a supply increase by OPEC on Mar 4th. The overall trend is bullish as long as support $59.20 holds.

Technically, the pair faces near-term resistance at 1.2700. Any indicative break above will take till 1.2755 (55- day EMA)/1.2800/1.2835. The significant support is around 1.2590; an indicative violation below will take to the 1.2520/1.2480.

Indicator (Daily chart)

CAM indicator – Neutral

Directional movement index –Neutral

It is good to sell on rallies around 1.2688-90 with SL around 1.2750 for a TP of 1.2590.