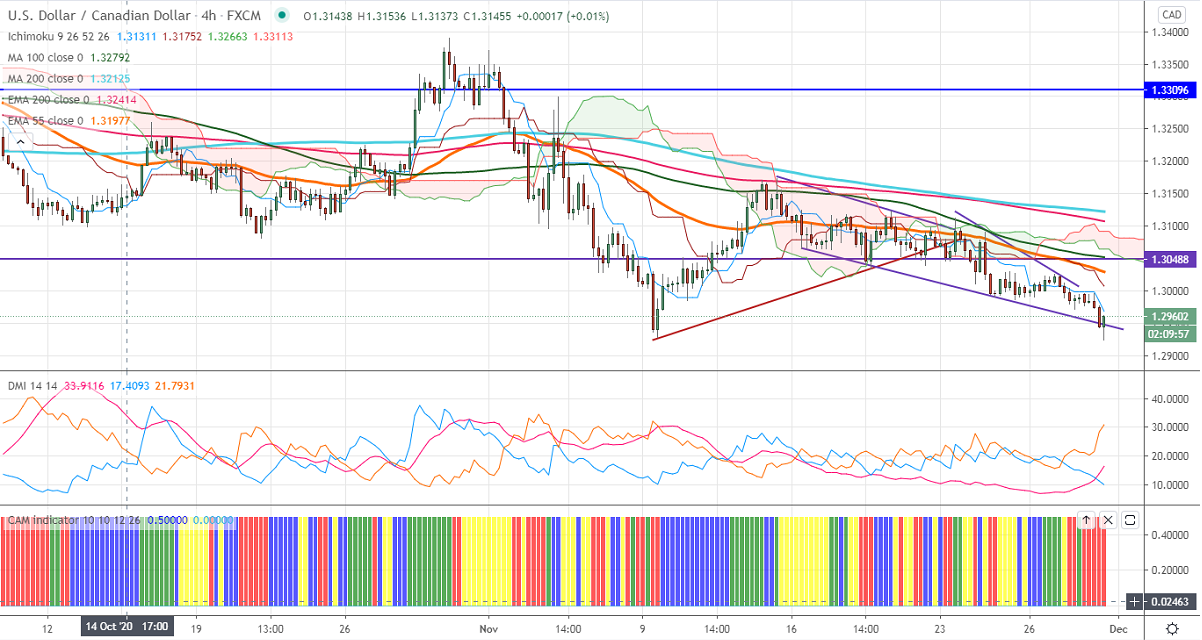

Ichimoku analysis (4 Hour Chart)

Tenken-Sen- 1.29839

Kijun-Sen- 1.30170

USDCAD continues to trade lower after a minor jump to 1.3000 levels. The broad-based US dollar weakness on COVID vaccine optimism is putting pressure on this par at higher levels. WTI crude oil price jumped more than 27% in November in hopes of an increase in demand. DXY hits a new 2 and a half month low, dip till 91 likely. Loonie hits an intraday low of 1.29235 and currently trading around 1.29404.

WTI crude oil is trading slightly weak, with any significant decline only below $43.85. A dip till $42.40 is possible.

Technically, the pair faces near term resistance at 1.300. Any violation above targets 1.3030/1.3050/1.3100. The near term support is around 1.2920; an indicative break below will take to the next level till 1.2880/1.2850.

It is good to sell on rallies around 1.2968-70 with SL around 1.3000 for the TP of 1.2880.