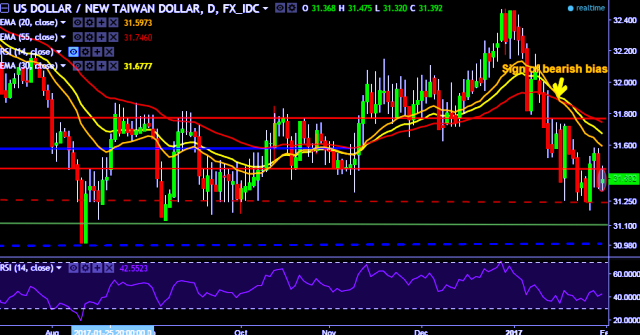

- USD/TWD is currently trading around 31.40 mark.

- It made intraday high at 31.47 and low at 31.32 marks.

- Intraday bias remains neutral till the time pair holds key support at 31.34 marks.

- A sustain close below 31.34 mark will test key supports at 31.13, 30.99 and 30.70 marks respectively.

- Alternatively, reversal from key support will drag the parity up towards key resistances around 31.44, 31.58, 31.72, 31.98, 32.12, 32.25, 32.43 and 32.63 marks respectively.

Positioning is inconclusive at this point, with prices offering no clear cut signal to initiate a long or short trade. We will continue to remain on sidelines for the time being.