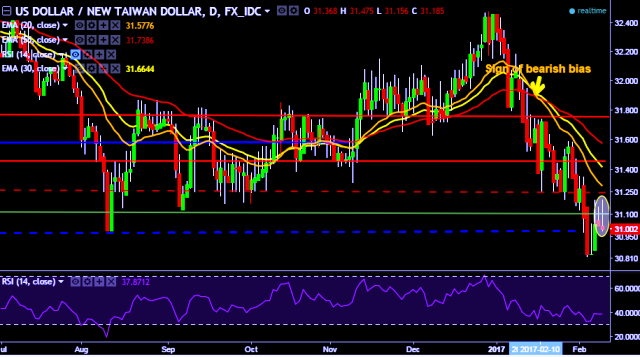

- USD/TWD is currently trading around 30.99 mark.

- It made intraday high at 31.19 and low at 30.98 marks.

- Intraday bias remains bearish for the moment.

- A sustained close below 31.00 mark will test key supports at 30.82, 30.77, 30.68 and 30.48 marks respectively.

- Alternatively, reversal from key support will drag the parity up towards key resistances around 31.19, 31.25, 31.35, 31.44, 31.58, 31.72, 31.98, 32.12, 32.25, 32.43 and 32.63 marks respectively.

- Taiwan stocks open up 0.1 pct at 9,555.52 points.

We prefer to take short position in USD/TWD around 31.00, stop loss 31.19 and target of 30.82/30.77.