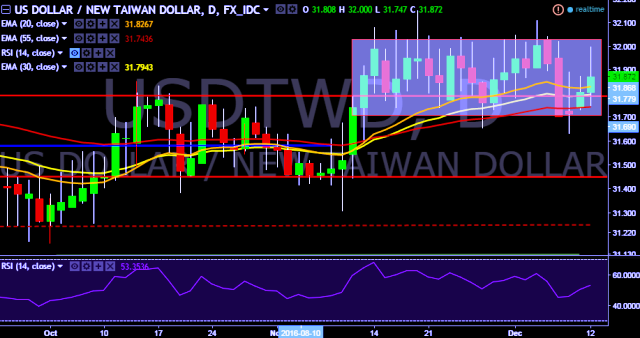

- USD/TWD is currently trading around 31.88 marks.

- It made intraday high at 32.00 and low at 31.74 marks.

- Intraday bias remains neutral for the moment.

- A daily close above 32.02 will drag the parity up towards key resistances around 32.20, 32.43 and 32.63 marks respectively.

- On the other side, key support levels are seen at 31.72, 31.56, 31.45, 31.38, 31.26, 31.18, 30.99, 30.85 and 30.39 marks respectively.

- Taiwan stocks open up 0.1 pct at 9,402.05 points.

Positioning is inconclusive at this point, with prices offering no clear cut signal to initiate a long or short trade. We will continue to remain on sidelines for the time being.