Turkish lira is We believe USD/TRY will trade above 3.25 in the coming months. The main drivers will likely be disregard of the inflation targeting regime and high levels of foreign liabilities. Headline inflation remains remarkably high despite the collapse in oil prices, because real interest rates remain low. Headline inflation is back above 8% with no signs of convergence towards the 5% target.

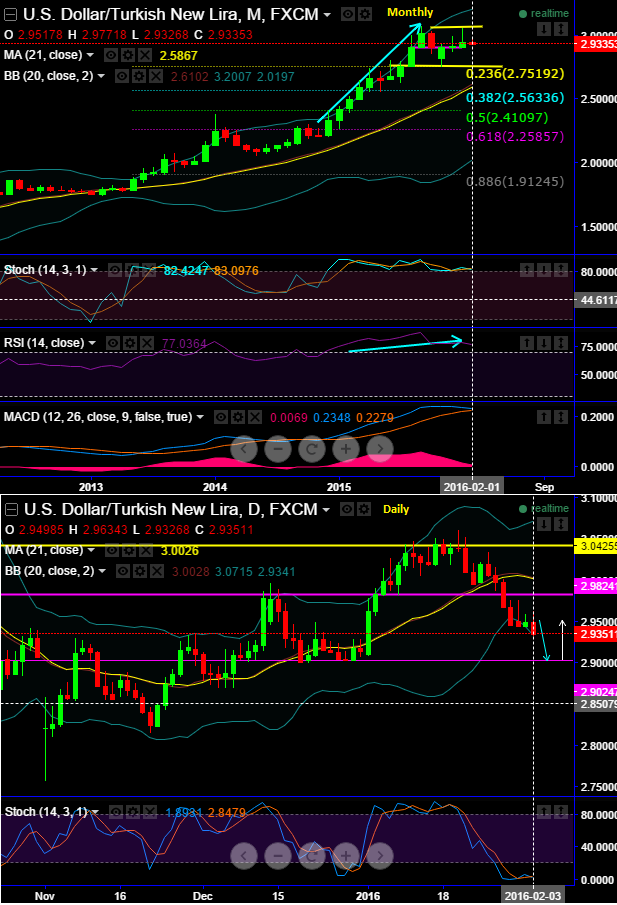

Technical glance: Although the pair is dipping down we don't think trend has reversed, a sharp bounce seems to be most likely as the stochastic curve has approached oversold zone and attempting for %K crossover.

Any minor abrupt price drops would not be surprised and misinterpreted as downtrend, we could see the maximum downside potential upto 2.9025 or even upto 2.7519 (23.6% fibo retracements on long term uptrend) that is where it is likely to find strong supports (see monthly charts).

RSI is also nearing 30s which is an oversold zone again signaling selling momentum. It would likely form a divergence by the time it hits 2.9025, thereby, price rally may resume.

Stochastic boils down some small price correction in short term. Even though the formation of shooting star pattern leading oscillators on monthly charts have halted in the overbought territory but still showing much strength on upside.

Despite some minor bearish targets, bulls likely to ignore and continue their business in Q1 2016, hence, this reignites us going along with the fundamental assumptions of technical analysis (never buck the major trend and don't study technical indicators or pattern in isolation).

Currently, the pair is struggling at 2.9368, for now 2.9824 (stiff resistance) would be the upside bracket and 2.7519 is what we could expect a maximum slip in downside drag, on flip side, the projections for USDTRY remains at around 3.20 by mid-2016.

To buy ATM strikes vs. sell 25D USD calls (short skew) in weighted amounts (OW 1Y) in a way that still leaves the resulting box spread net long a substantial amount of gamma and a small amount of vega.

Long USD/TRY 1Y ATM vol vs. short 2Y 25D USD calls/TRY puts, 150:100 vega ratio (delta-hedged): Turkey's macro vulnerabilities are fairly projected, a bulky Turkish CAD, too much dependence on overseas portfolio financing, 7%+ inflation.

FxWirePro: USD/TRY may bounce back to 3.25 by Q1 end – stay hedged via diagonal combinations

Wednesday, February 3, 2016 12:27 PM UTC

Editor's Picks

- Market Data

Most Popular