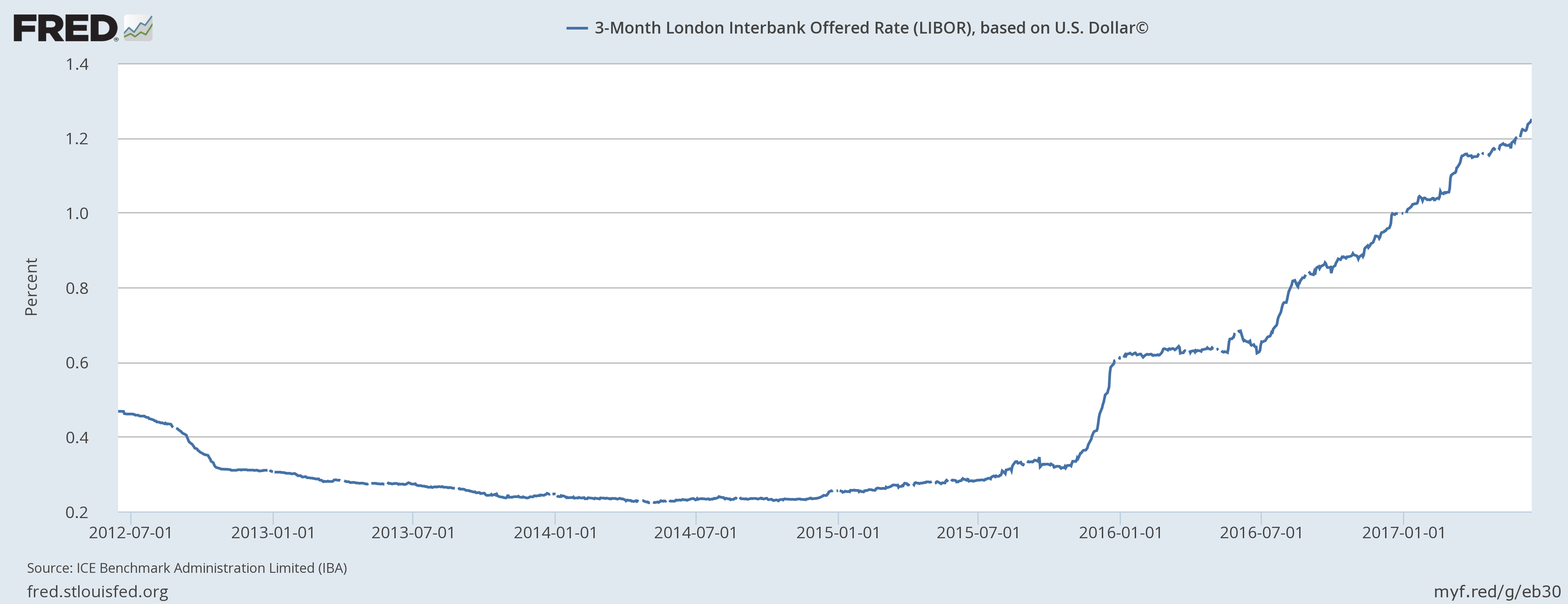

The London Interbank Offered Rate (LIBOR) based on the U.S. dollar that basically reflects U.S. dollar funding cost in the interbank market has reached the highest level since 2009. 3-month USD LIBOR is currently trading at 1.287 percent, which is higher by almost 30 basis points since the beginning of the year. It rose by 10 basis points in the first quarter of the year. After a long decline since the 2008/09 Great Recession thanks to easy monetary policy, the USD Libor has started reversing course by the end of 2014 and has increased by more than 100 basis points.

However, the funding risks in the market remain low as measured by the TED spread. TED spread is the difference between the 3-month USD LIBOR and equivalent treasury, which can be seen as additional cost due to unsecured funding. After increasing to the highest level in September last year around 67 basis points, the spread has eased more than 40 basis points and is currently trading at just 26 basis points. It is also at the lowest level since December 2015, a time when the U.S. Federal Reserve hiked rates for the first time.

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election