The trade protectionism theme that took place last week, shot back into focus as a potential major left tail risk for markets which got further aggravated by the subsequent retaliatory rhetoric from Europe and Asia. President Trump has followed through on his promise to impose tariffs on steel and aluminum imports but alleviated the worst of the retaliation fears by excluding Canada and Mexico and leaving the door open for other US trade partners to be given similar exemptions. With risk on-risk off flip-flopping throughout the week gamma returns under-delivered.

Offsets of trade tensions, twin deficits, and a hawkish Fed may well keep the broad dollar within a choppy range, but we doubt that the absence of a clear trend alone will suffice to revert FX vols to their 2017 lows since there is now widespread recognition that option markets have durably turned the page on last year’s aberrant low volatility regime.

One shouldn’t forget that the primary casualty in FX options markets of the stall in the weak dollar trend over the recent past is the fall-off in directional investor demand for USD puts that was so pivotal to the surge in front-end vols earlier in the year.

The bar for outright vol selling is considerably higher this year, but that does not preclude exploiting pockets of receding of dollar momentum to tactically harvest theta when curve shapes and realized vols co-operate. USDKRW is one of the best candidates to do so currently.

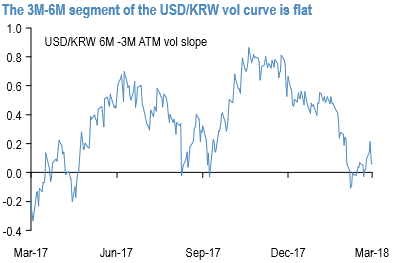

First, the 3M-6M segment of the KRW vol curve is flat (refer 1st chart), so naturally lends itself to short front vs. long back curve steepeners.

Secondly, KRW is one of the notable laggards in the normalization of FX vols from their VIX spike highs as discussed earlier, hence there is room for the front-end of the curve to sag.

Thirdly, realized vols in USDKRW have cratered over the past two weeks, and are now running a substantial 2-3 pts. under 3M ATMs (refer 2nd chart). Absent another SPX shock, subdued KRW realized vols can persist given tailwinds from equity inflows, the won’s trade-related appreciation bias and a more symmetric policy lean against bouts of sharp FX rallies and sell-offs.

Not surprisingly, the combination of high implied/realized vol ratios and a relatively tight 1055-1095 spot range this year also marks it out as one of the better range plays on our double no-touch (DNT) screens. The vanilla expression of the KRW calendar is a short 3M vs. long 6M vega-neutral vanilla structure.

For investors constrained from assuming uncapped downside risk in vanilla KRW options on geopolitical risk considerations, one-touch calendars are a viable alternative; for instance, short 2M vs. long 4M 1050 strike calendar spreads cost 19% at inception (spot ref. 1072) and roll up statically to 38% in unchanged markets (2X gearing), potentially even a fair bit more if spot were to slip lower towards the middle of its YTD range around 1070; the 1050 strike is also below the 1060 floor that official jawboning has placed under spot this year. Courtesy: JPM

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One