Currency Derivatives Insights:

In the interest of speculators we see buying opportunities in USD/JPY binary puts on rallies for a target of 122.75 1st and even upto 122.50 levels. We look at either shorting futures of this pair to hit targets of 122.50 & then even 122 levels in medium terms or buying binary puts at current prices can also be beneficial for the same targets with a strict stop loss at 123.50. Thereby risk reward ratio would be at 0.33.

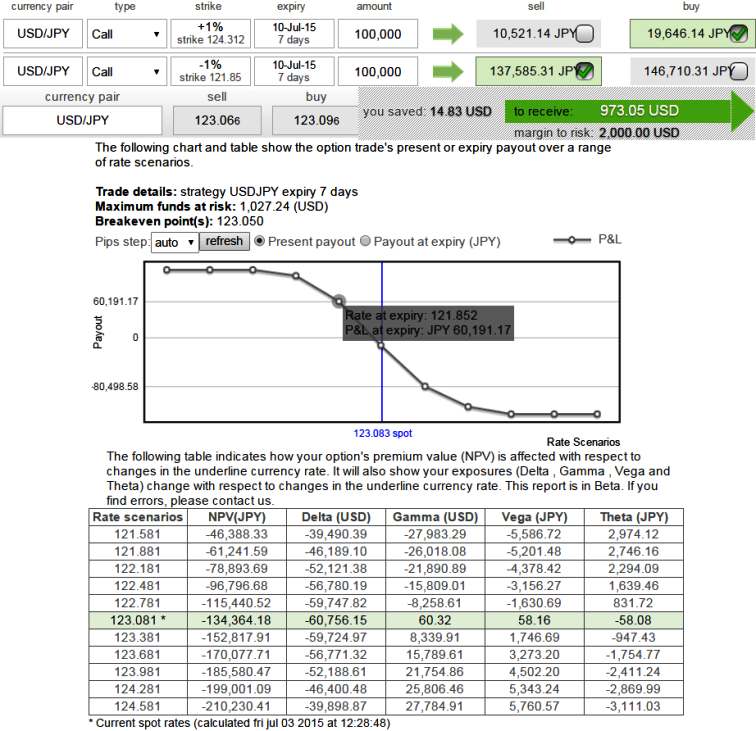

Option Strategy: Credit Call Spread

Hedgers should focus on better bear spreads that offers optimal entry points at around 123 levels.

In order to establish the above stated strategy, hedgers should execute on selling a call option and purchase another call at a higher strike price for a net credit.

A bear call spread is better over short call since it has limited risk unlike unlimited risk in case of naked short calls.

Use a short time for maturity (something like 15 day to near month contracts bearing positive theta value) to take advantage of the time decay and give the underlying currency less time to go against you.

Therefore the recommendation would be, buy 7D (1%) Out-Of-The-Money 0.20 delta calls and sell 7D (-1%) In-The-Money calls with positive theta value for net credit receivable. The combined delta should have negative delta somewhere close to -0.60 as we have shorts on ITM calls in our position.

FxWirePro: USD/JPY swing trade using binary puts worthy for targets at 122.50; credit spreads for hedging

Friday, July 3, 2015 7:18 AM UTC

Editor's Picks

- Market Data

Most Popular

2

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate