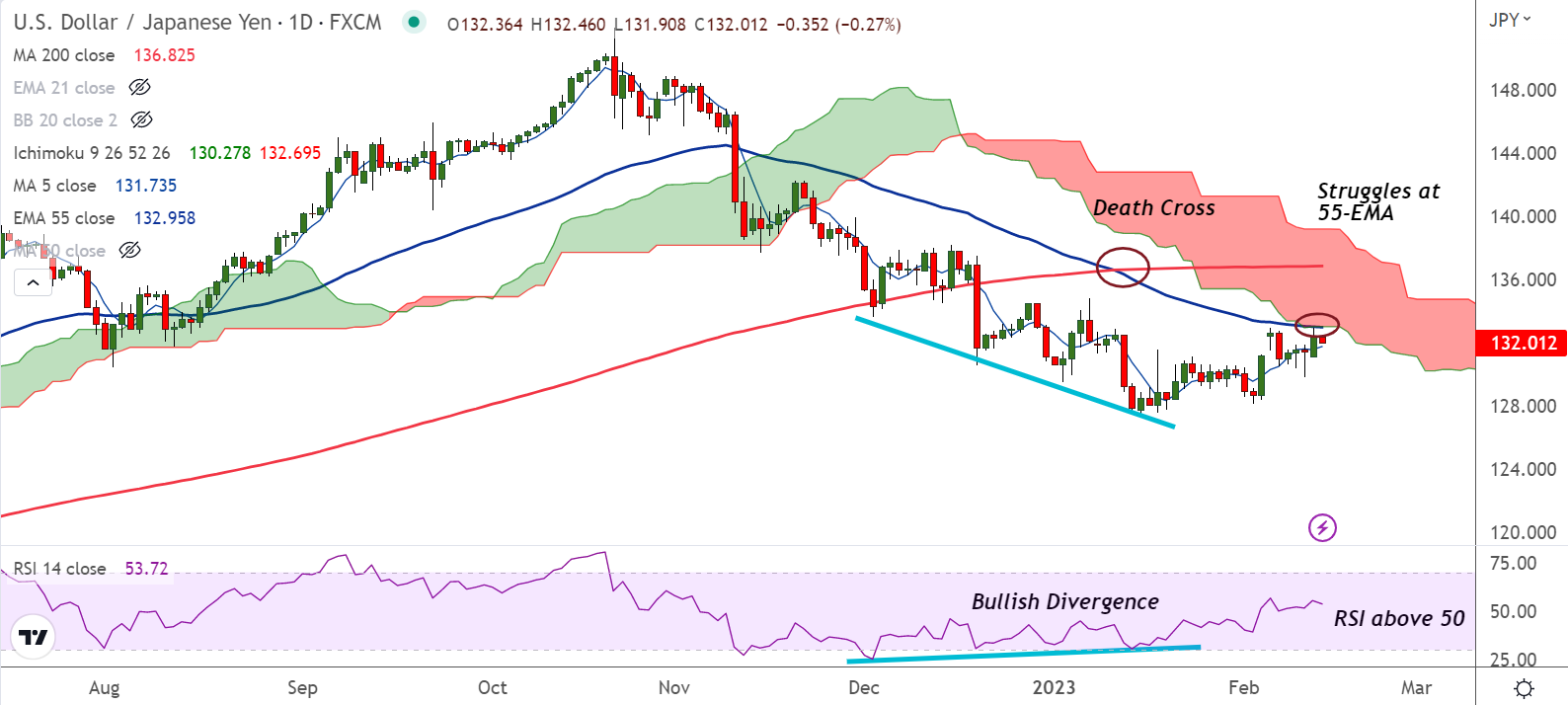

Chart - Courtesy Trading View

USD/JPY was trading 0.23% lower on the day at 132.05 at around 04:20 GMT, upside capped at 55-EMA and daily cloud.

Later on the day, U.S. Bureau of Labor Statistics will release January's consumer price index (CPI) data, which will determine further price action.

Inflation data will show the effectiveness of Fed's policy tightening in taming inflation. Investors confident that data would show an easing in inflation.

However, according to Reuters poll, the headline CPI is expected to rise 0.5%, with the core number seen advancing 0.4%. On an annual basis, consumer price inflation likely eased to 6.2%, from 6.5% in December.

On the other side the yen recouped losses as Japan nominated a new central bank governor. Ueda would succeed Haruhiko Kuroda, whose term ends on April 8.

The Japanese Cabinet also nominated Former Financial Services Agency (FSA) chief Ryozo Himino and career central banker and BoJ executive Shinichi Uchida as the two deputy governors.

USD/JPY has paused upside at 55-EMA and daily cloud resistance. Bullish RSI divergence is driving upside in the pair.

That said, a 'Death Cross' (bearish 50-DMA crossover on 200-DMA) keeps downside pressure, capping upside in the pair.

Major Support Levels:

S1: 131.71 (5-DMA)

S2: 131.04 (21-EMA)

Major Resistance Levels:

R1: 133.00 (converged daily cloud and 55-EMA)

R2: 134.88 (110-EMA)

Summary: USD/JPY trades with a bullish technical bias. Price action is consolidating above 21-EMA. Break above 55-EMA and into daily cloud will see further gains.