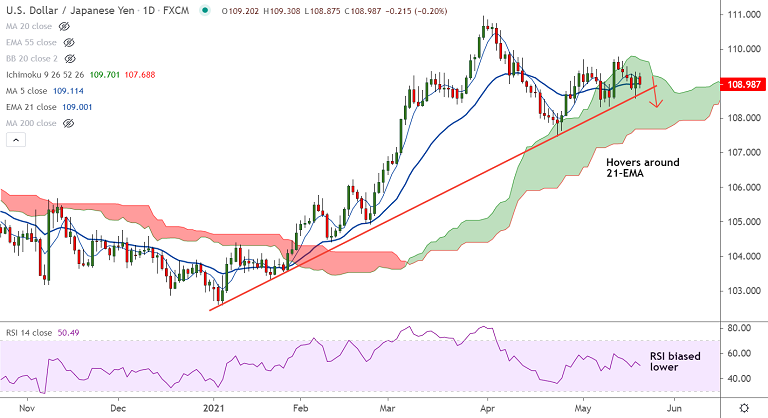

USD/JPY chart - Trading View

USD/JPY was trading 0.20% lower on the day at 108.97 at around 08:40 GMT, erasing a part of the overnight gains.

The major was struggling to extend previous session's FOMC minutes-led gains. A modest pullback in the US Treasury bond yields kept a lid on the upside.

Renewed fears of Fed tapering buoyed the US Dollar and Treasury yields, boosted the pair higher overnight.

At its April meeting, the Fed held interest rates near zero and pledged to continue buying $80 billion in Treasuries and $40 billion in mortgage-backed securities until “substantial further progress” on their employment and inflation goals.

Fed officials were cautiously optimistic about the US economic recovery at the central bank’s April meeting, with some officials signaling they’d be open to discussing taper “at some point.”

Later in the US docket today, focus on the Philly Fed Manufacturing Index and the Initial Weekly Jobless Claims for impetus.

Focus also on the upcoming release of US PMI data, for any evidence of not-so transitory inflation amid persistent supply chain disruptions could intensify the Fed taper debate.

Support levels - 108.93 (20-DMA), 108.48 (55-EMA), 108

Resistance levels - 109.10 (5-DMA), 109.70 (Cloud top), 110

Summary: USD/JPY spiked over 0.30% overnight and closed at 109.20 slightly lower from session highs at 109.33.

The pair is struggling to extend previous session's gains and hovers around 20-DMA support. Break below could drag the pair lower.