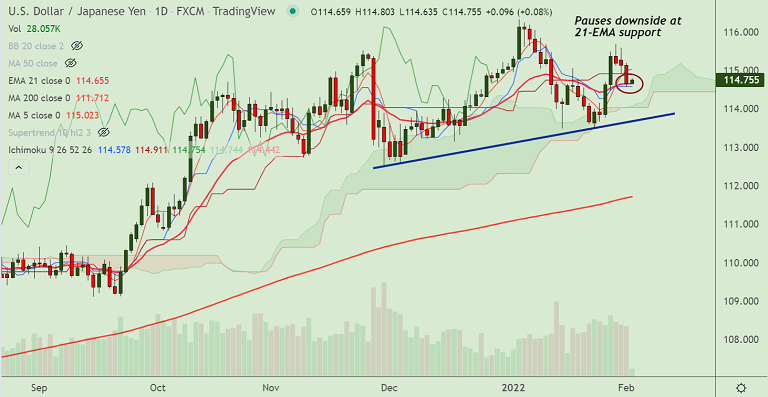

Chart - Courtesy Trading View

Spot Analysis:

USD/JPY was trading 0.07% higher on the day at 114.74 at around 06:30 GMT.

Previous Week's High/ Low: 115.68/ 113.47

Previous Session's High/ Low: 115.19/ 114.56

Fundamental Overview:

Data released overnight showed US ISM PMI Manufacturing Price Index jumped to 78.1 from 68.1.

However, the Manufacturing Prices Index smashed forecasts, climbing to 76.1 from 68.1 estimated, further cementing Fed rate hikes in 2022.

Further, US IHS Markit Manufacturing PMI came at 55.5, slightly up than the 55.0 estimated.

Mixed comments from the US Federal Reserve (Fed) officials and indecision over the Russia-Ukraine issues keep traders wary.

Recent Fedspeak tests the US dollar bulls ahead of the key US jobs report for January, due this Friday.

Focus today will be on US ADP Employment Change for January along with risk catalysts for impetus.

Technical Analysis:

- USD/JPY has snapped a 3-day bearish streak at 21-EMA support

- Price action hovers above 200H MA support, break below will see more weakness

- Stochs and RSI show momentum is still bullish and volatility is high

- GMMA indicator shows major trend is bullish, while minor trend is turning bearish

Major Support and Resistance Levels:

Support - 114.65 (21-EMA), Resistance - 115.01 (5-DMA)

Summary: USD/JPY pivotal at 21-EMA support. Weakness only on break below.