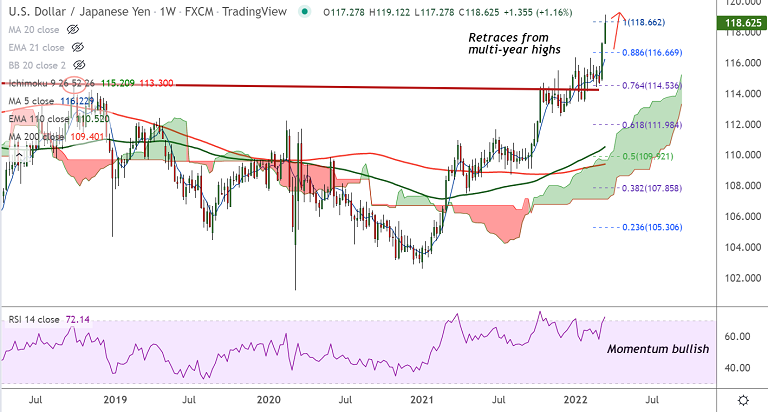

Chart - Courtesy Trading View

USD/JPY was trading largely muted at 118.69 at around 09:30 GMT, bias is bullish.

The Federal Reserve (Fed) raised interest rates higher by 25 basis points (bps) as expected.

The central bank announced equivalent hikes at every meeting for the remainder of this year to aggressively stamp out inflation.

Fed has announced seven interest rate hikes this year, an aggressive hawkish stance for the remaining monetary policies of 2022.

Focus now on Bank of Japan (BOJ) which will announce its interest rate decision on Friday.

The BOJ is likely to maintain the status quo by keeping the interest rates unchanged at 0.1%.

Major Support Levels:

S1: 118.22 (5-DMA)

S2: 116.89 (200H MA)

S3: 116.44 (21-EMA)

Major Resistance Levels:

R1: 119

R2: 120

R3: 121.48 (Feb 2016 high)

Summary: USD/JPY major trend remains bullish. However, overbought oscillators might cause some pullbacks. Bullish invalidation only below daily cloud.