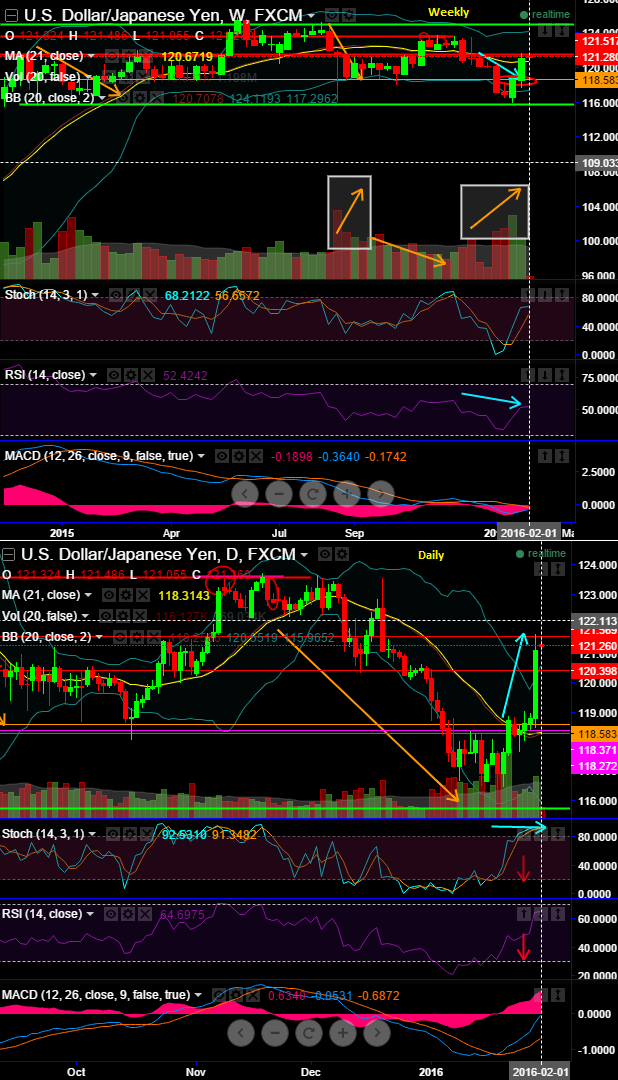

USD/JPY has rejected the rallies today again at 121.486 (our recent pivot point 121.587).

Last week, as the pair has been constrained within the range of 119.001 to 117.656, Friday's spike (momentary owing BoJ's policy stance) could not sustain above stated resistance and slipping back towards 21DMA (mid-line of BB).

On weekly charts, we could foresee in short to medium run all signs of attempts to retesting supports at 120.398 and 118.583 regions again, on a long-term perspective, the non-directional to slightly bearish bias trend to persist that has lasted for almost 1 year that remained in the range of 115.750 - 125.856.

Since USD/JPY's uptrend is rejected at 121.486, other oscillating indicators shown a clear divergence to the previous upswings in sideway trend; for now bearish sensation is piling up although interim upswings cannot be disregarded.

BB (100, 2)

RSI (14) above overbought (80's) attempting for bearish crossover.

Stochastic: %K crossover above oversold region.

The strategy requires and suits for high volatile market, As per the OTC observation USDJPY is likely to perceive 12.25% implied vols for 1W expiries which is second highest among G7 space after USDCAD, we need to see the lower or upper bands spiked and bands far apart.

If bands tight together up to 50 pips no trades, as my entry comes after the price has broken the red green lines with rsi histogram turning the correct colour also.

Scenario: When price goes down, spikes lower bands, the lines are also slumping down, now wait for price to close the downward sloping blue lines and leading indicators to diverge these price dips and wait for Stochs and RSI lines turns spiking up.

Even if the price closes the blue BB lines but RSI is still below oversold territory, prefer not to touch the price, leading oscillators need to approve for fresh longs.

Eye on binary calls when above conditions satisfy after keeping 25 points stop loss for 40 TPs, thereby, one can have ideal risk reward ratio when you get double the risk, immediately should square off the position.

FxWirePro: USD/JPY rejects at resistance 121.486 – more dips underway

Monday, February 1, 2016 9:08 AM UTC

Editor's Picks

- Market Data

Most Popular

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate