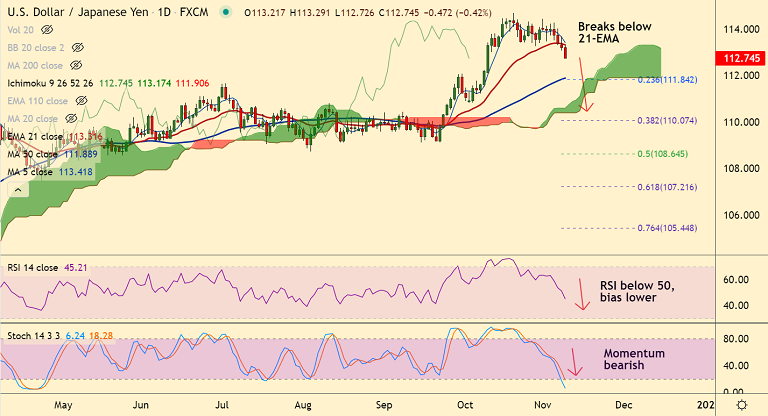

USD/JPY chart - Trading View

USD/JPY stands on slippery ground near 112.75 on downbeat Treasury yields. The major was trading 0.40% lower on the day at around 05:35 GMT.

Fears concerning the US Federal Reserve’s (Fed) tapering and anxiety over the Fed reshuffle seem to exert a great deal of pressure on the market sentiment supporting the yen.

Price action has breached 21-EMA support, and has tested fresh 4-week lows, outlook bearish.

Technical indicators are bearish, Stochs and RSI are sharply lower, momentum is strongly bearish.

Price action is below 200H MA, GMMA indicator shows near-term moving averages have turned bearish on the daily charts.

MACD supports downside. -ve DMI crossover on +ve DMI adds to the downside bias. Volatility is rising as evidenced by widening Bollinger bands.

Focus on US inflation data (due Wednesday). Analysts expect consumer price at 5.8% year-on-year, supporting the Federal Reserve's intent to be patient with interest rate hikes.

Major Support Levels:

S1: 112.20 (55-EMA)

S2: 111.89 (50-DMA)

S3: 111.10 (110-EMA)

Major Resistance Levels:

R1: 113

R2: 113.31 (21-EMA)

R3: 113.42 (5-DMA)

Summary: USD/JPY on track for further weakness. Dip till 55-EMA at 112.20 likely.