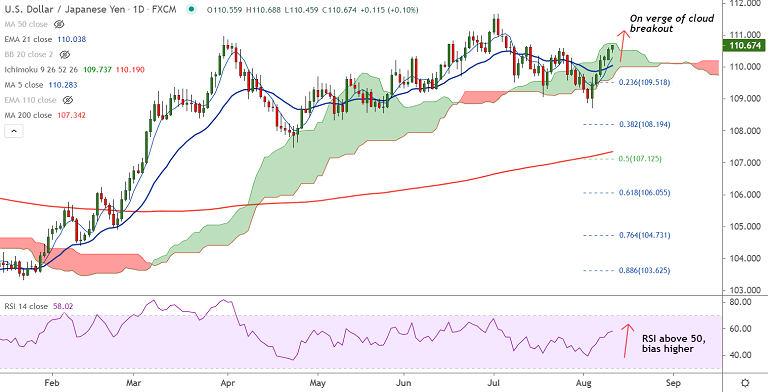

USD/JPY chart - Trading View

USD/JPY refreshes 4-week highs, was trading 0.10% higher on the day at 110.67 at 04:50 GMT, outlook bullish.

Worries over a surge in coronavirus' Delta variant cases kept safe-haven demand for the dollar.

U.S. Treasury yields extended gains in Asia on Wednesday, spurred by taper talk amid improving economic data.

The major is on track for breakout above daily cloud. Technical indicators support upside in the pair.

Investors now await the monthly U.S. personal consumption report due at 1230 GMT that could influence the Fed's timeline to taper monetary support.

USD could get a further boost from an upbeat inflation reading, adding to expectations of policy tightening.

Major Support Levels:

S1: 110.28 (5-DMA)

S2: 110.03 (21-EMA)

S3: 109.88 (55-EMA)

Major Resistance Levels:

R1: 110.73 (Cloud top)

R2: 111 (Psychological level)

R3: 111.35 (Upper W BB)

Summary: USD/JPY trades with a bullish bias. Upbeat inflation data could boost the dollar further. Watch out for break above daily cloud for further gains. Scope for test of 111.35.