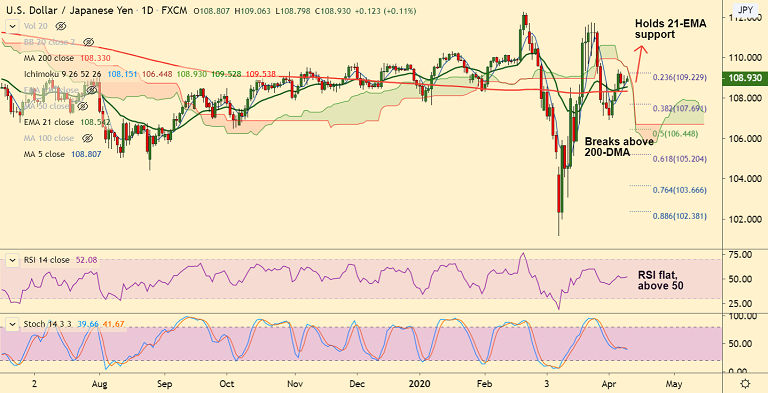

USD/JPY chart - Trading View

USD/JPY was trading marginally higher on the day at 108.94 at around 06:45 GMT.

The pair has held support at 21-EMA on Wednesday's trade, weakness only on break below.

FOMC minutes overnight highlighted concerns over the swiftness with which the coronavirus outbreak was harming the U.S. economy and disrupting financial markets.

The Fed reiterated that it would be appropriate to maintain rates at the current near-zero levels.

Fed Powell's speech and US jobs data will be watched for impetus ahead of the long weekend.

GMMA indicator shows major trend in the pair is neutral and minor trend is turning slightly bullish.

Daily cloud is stiff resistance. Break above could buoy prices. On the flipside, failure to hold above 200-DMA will negate any upside bias.

Major Support Levels - 108.54 (21-EMA), 108.33 (200-DMA), 107.69 (38.2% Fib)

Major Resistance Levels - 109.22 (23.6% Fib), 109.53 (Daily cloud), 109.66 (200W MA)

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty