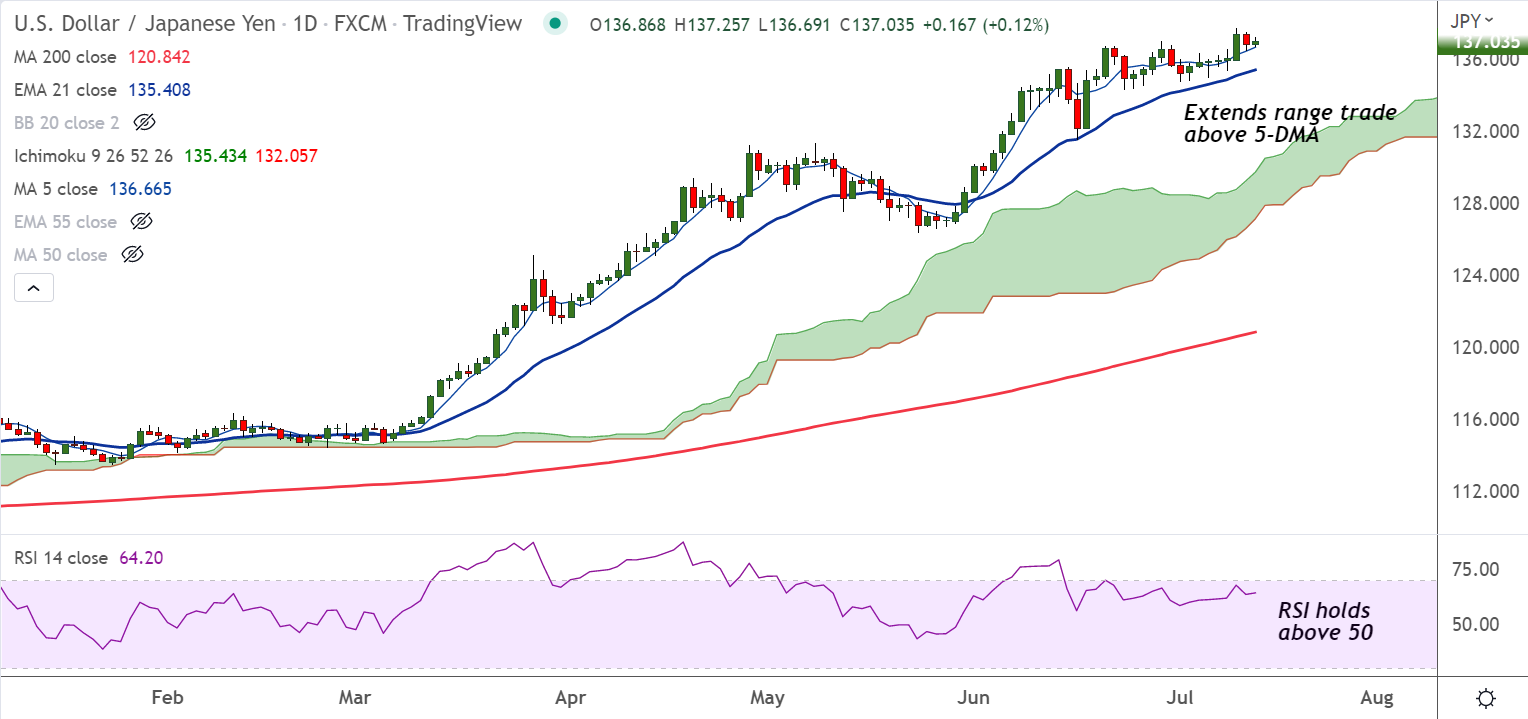

Chart - Courtesy Trading View

USD/JPY was trading largely muted, 0.07% higher on the day at 136.95 at around 05:40 GMT.

Continuation of the dovish stance by the Bank of Japan (BOJ) will weaken the yen bulls further.

Technical indicators support upside in the pair. Price action is above 5-DMA and momentum studies are bullish.

On the data front, US NFIB Business Optimism Index for June slumped to the lowest since early 2013 while flashing 89.5 figures versus 93.1 prior.

US CPI for June will be a crucial event. US Consumer Price Index (CPI) for June is expected to rise to 8.8% YoY from 8.6%.

Strong inflation numbers could increase the odds of a faster Fed rate hike and support the pair higher. Any negative surprise could see weakness in the pair.

Further, Friday’s US Retail Sales will also remain in focus. Retail sales are expected to print higher at 0.8% from a prior reading of -0.3%.

Major Support Levels:

S1: 136.66 (5-DMA)

S2: 135.73 (20-DMA)

Major Resistance Levels:

R1: 137.88 (Upper BB)

R2: 138

Summary: Price action is extending bounce off 21-EMA support. The pair is poised to refresh multi-year highs above 137.75.