- The USD/JPY declined on Friday as strong rebound in US stocks and strong showing in US consumer spending supported dollar bulls.

- Further upside is expected to be limited as the pair finds strong resistance at 113.79 which should limit upside and bring a decline towards lower levels.

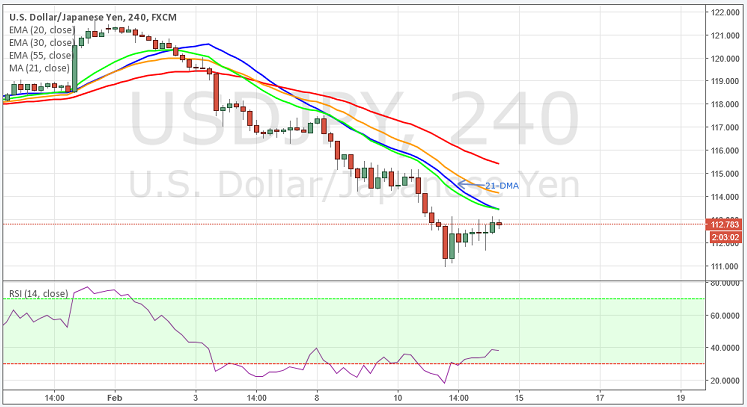

- Technically the pair has extended its decline below its 21 DMA, the RSI in the 4 hour chart is indicating downwards at 30, meanwhile the 55, 30 and 20 MA's are pointing strong bearish momentum towards lower side. Overall the technical indicators are depicting further downtrend for this pair.

- To the upside, the strong resistance can be seen at 113.20, a break above this level would take the pair towards next resistance level at 113.79.

- To the downside immediate support can be seen at 111.40, a break below this level will open the door towards next level at 110.95.

Recommendation: Go short around 113.30, targets 112.00, 111.50, SL 114.00.

Resistance Levels

R1: 112.57 (50% Retracement Level)R2: 113.20 (Daily high)

R3: 113.79 (61.8% Retracement Level)

Support Levels

S1: 111.40 (38.2% Retracement Level)

S2: 110.95 (Feb 11th lows)

S3:110.00 (23.6% Retracement Level)

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022