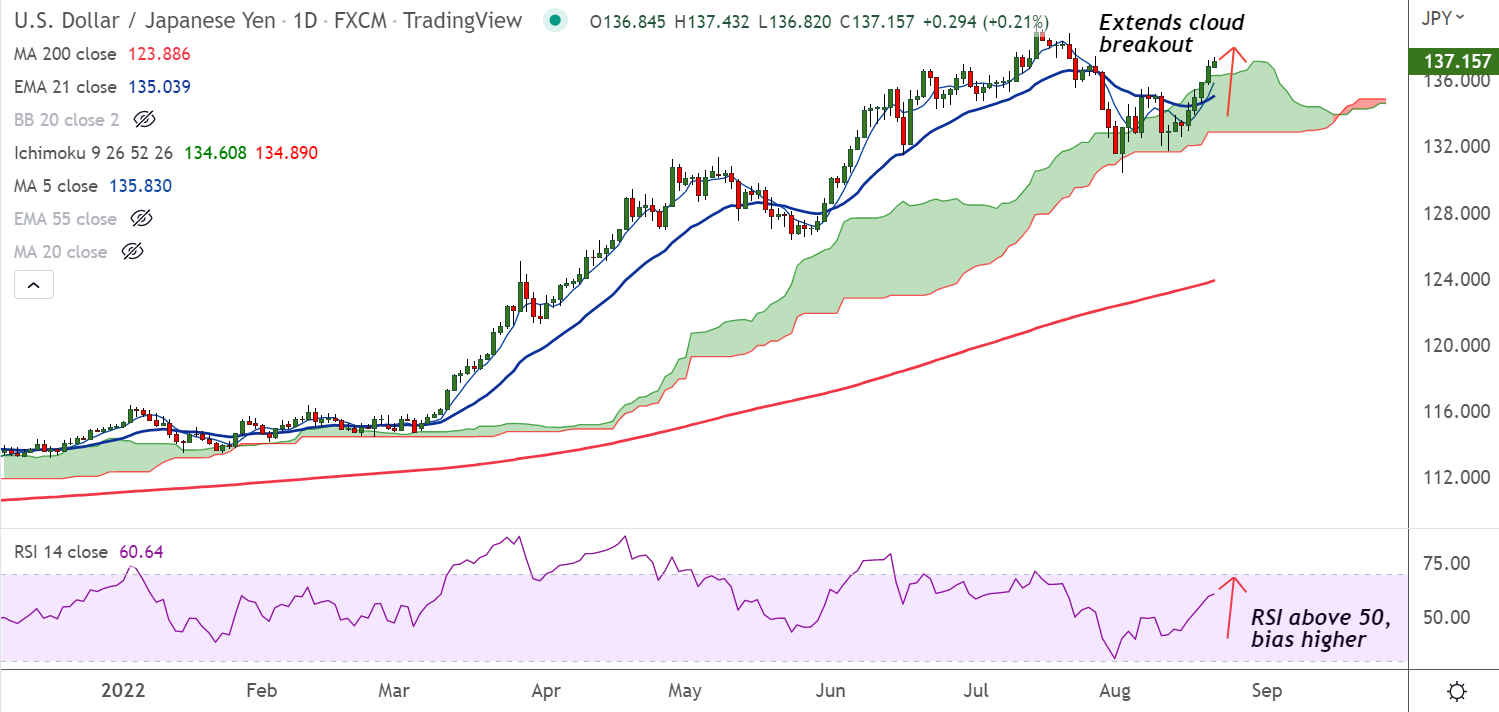

Chart - Courtesy Trading View

USD/JPY was trading 0.23% lower on the day at 137.18 at around 05:30 GMT, focus on the Jackson Hole symposium for impetus.

The pair opens the week on a bullish note, is extending gains for the 6th straight session, technical bias is bullish.

Federal Reserve (Fed) policymakers have shown mixed commentary as price pressures have trimmed suggesting a possible slowdown in the pace of hiking interest rates.

Uncertainty over the commentary from the Fed at the Jackson Hole symposium will keep prices volatile.

Investors also await the release of the US Durable Goods Orders data, which is expected to decline to 0.6% from the prior release of 2%.

Major Support Levels:

S1: 136.30 (Cloud top)

S2: 135.83 (5-DMA)

Major Resistance Levels:

R1: 137.55 (Upper BB)

R2: 139.38 (July 2022 high)

Summary: USD/JPY trades with a bullish bias. Pullback has bounced off cloud base support. Breakout above cloud has opened upside. Scope for pair to refresh yearly high above 139.38.